Exhibit (c)(4)

Strictly Private and Confidential DRAFT / Analysis Subject to Further Review > discussion materials Allego Transaction Committee | 17 April 2024

Exhibit (c)(4)

Strictly Private and Confidential DRAFT / Analysis Subject to Further Review > discussion materials Allego Transaction Committee | 17 April 2024

DRAFT / Analysis Subject to Further Review Proposed Discussion Agenda • Feedback from MS discussion • proposal review • Updates on and • Response to / / / Meridiam • Next steps • Allego> 2

Meridiam Proposal Clarification Points DRAFT / Analysis Subject to Further Review Call between Citi (advisor to the Transaction Committee) and Morgan Stanley (advisor to Meridiam) held on 16/ 4/ 2024 How is Meridiam funding the tender offer? Meridiam have had discussions with lenders to support the tender offer and would be open to sharing support letters in due course They have no intention to push down any debt to Allego post settlement Does Meridiam have any intention to undertake a squeeze-out of non-tendering minorities post delisting, through statutory proceedings or otherwise? Meridiam are not contemplating forcing holders into selling. Hence their structure does not include squeeze-out procedures, just a liquidity option (the tender offer) for shareholders who wish to tender How does Meridiam intend to fund, or support the funding of, the company once delisted? To be discussed with Meridiam - implied no plans currently in place Are Meridiam committed to remaining Allego’s controlling shareholder for the medium to long term? What is the remaining investment horizon? To be discussed with Meridiam What arrangements do Meridiam envisage putting in place to provide shareholders that remain invested with opportunities to exit post delisting? To be discussed with Meridiam Have Meridiam communicated their intentions to Apollo? Unable to comment at this stage 3 Allego>

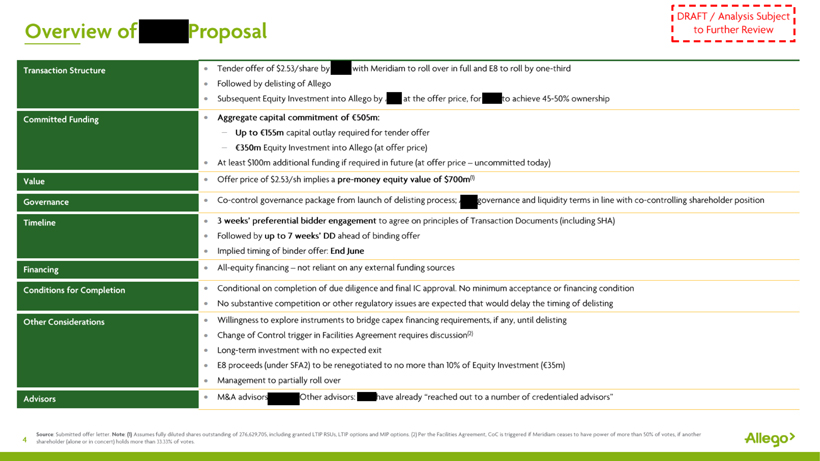

DRAFT / Analysis Subject to Further Review Overview of Proposal Transaction Structure • Tender offer of $2.53/share by with Meridiam to roll over in full and E8 to roll by one-third • Followed by delisting of Allego • Subsequent Equity Investment into Allego by at the offer price, for to achieve 45-50% ownership Committed Funding • Aggregate capital commitment of €505m: Up to €155m capital outlay required for tender offer €350m Equity Investment into Allego (at offer price) • At least $100m additional funding if required in future (at offer price - uncommitted today) Value • Offer price of $2.53/sh implies a pre-money equity value of $700m(l) Governance • Co-control governance package from launch of delisting process; governance and liquidity terms in line with co-controlling shareholder position Timeline • 3 weeks’ preferential bidder engagement to agree on principles of Transaction Documents (including SHA) • Followed by up to 7 weeks’ DD ahead of binding offer • Implied timing of binder offer: End June Financing • All-equity financing- not reliant on any external funding sources Conditions for Completion • Conditional on completion of due diligence and final IC approval. No minimum acceptance or financing condition • No substantive competition or other regulatory issues are expected that would delay the timing of delisting Other Considerations • Willingness to explore instruments to bridge capex financing requirements, if any, until delisting • Change of Control trigger in Facilities Agreement requires discussion(2) • Long-term investment with no expected exit • E8 proceeds (under SFA2) to be renegotiated to no more than 10% of Equity Investment (€35m) • Management to partially roll over Advisors • M&A advisors Other advisors: have already “reached out to a number of credentialed advisors” Source: Submitted offer letter. Note: (1) Assumes fully diluted shares outstanding of 276,629,705, including granted LTIP RSUs, LTIP options and MIP options. (2) Per the Facillities Agreement, CoC is triggered if Meridiam ceases to have power of more than 50% of votes, if another shareholder (alone or in concert) holds more than 33.33% of votes. 4

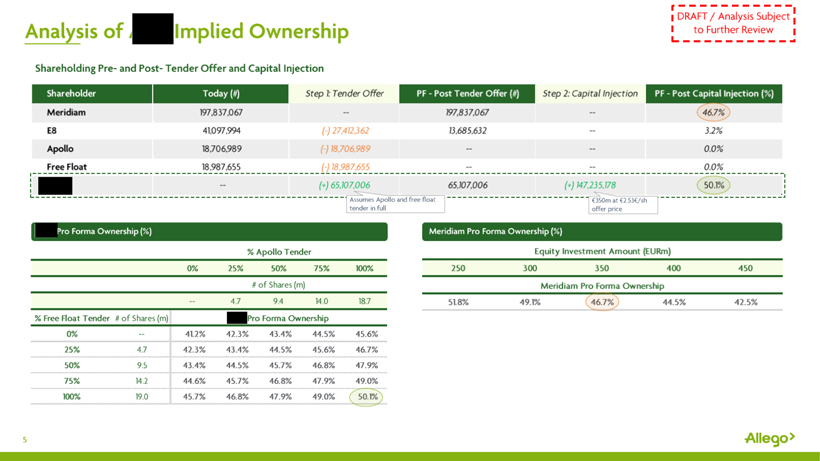

DRAFT / Analysis Subject to Further Review Analysis of Implied Ownership Shareholding Pre- and Post- Tender Offer and Capital Injection Shareholder Meridiam E8 Apollo Free Float Today (#) 197,837,067 41,097,994 18,706,989 18,987,655 --Step 1: Tender Offer -- (-) 27,412,362 (-) 18,706,989 (-)18,987,655 (+) 65,107,006 PF- Post Tender Offer (#) 197,837,067 13,685,632 -- -- 65,107,006 Step 2: Capital Injection -- -- -- -- (+) 147,235,178 PF - Post Capital Injection (%) 46.7% 3.2% 0.0% 0.0% 50.1% Pro Forma Ownership(%) % Apollo Tender 0% 25% 50% 75% 100% # of Shares (m) -- 4.7 9.4 14 .0 18.7 %Free Float Tender # of Shares (m) Pro Forma Ownership 0% 25% 50% 75% 100% -- 4.7 9.5 14.2 19.0 41.2% 42.3% 43.4% 44.6% 45.7% 42.3% 43.4% 44.5% 45.7% 46.8% 43.4% 44.5% 45.7% 46.8% 47.9% 44.5% 45.6% 46.8% 47.9% 49.0% 45.6% 46.7% 47.9% 49.0% 50.1% Meridiam Pro Forma Ownership(%) Equity Investment Amount (EURm) 250 300 350 400 450 Meridiam Pro Forma Ownership 51.8% 49.1% 46.7% 44.5% 42.5% 5 Allego> Assumes Apollo and free float tender in full €350m at €2.53€/sh offer price

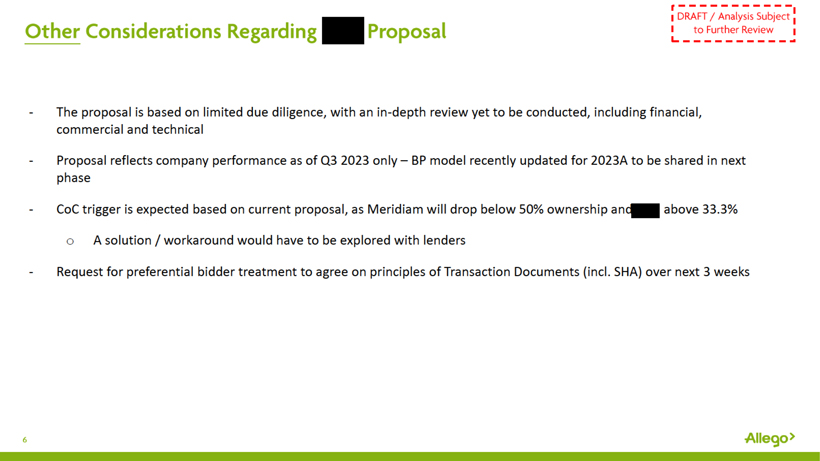

DRAFT / Analysis Subject to Further Review Other Considerations Regarding Proposal The proposal is based on limited due diligence, with an in-depth review yet to be conducted, including financial, commercial and technical Proposal reflects company performance as of Q3 2023 only- BP model recently updated for 2023A to be shared in next phase CoC trigger is expected based on current proposal, as Meridiam will drop below 50% ownership and above 33.3% o A solution / workaround would have to be explored with lenders Request for preferential bidder treatment to agree on principles of Transaction Documents (incl. SHA) over next 3 weeks Allego> 6

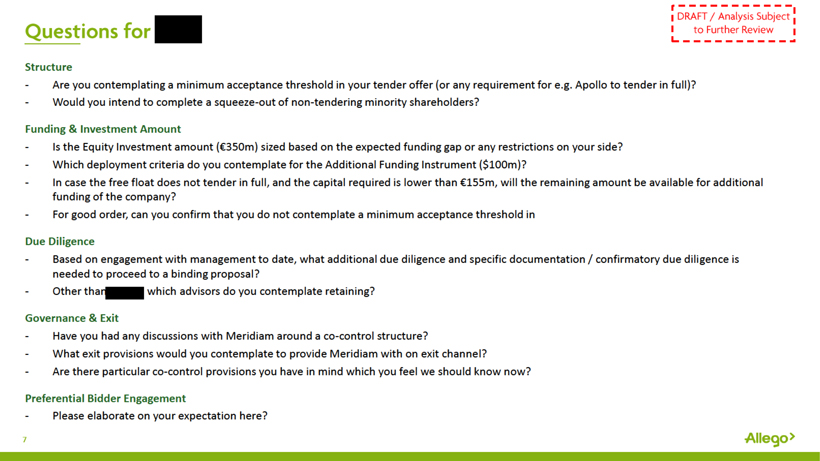

DRAFT / Analysis Subject to Further Review Questions for Structure Are you contemplating a minimum acceptance threshold in your tender offer (or any requirement for e.g. Apollo to tender in full)? Would you intend to complete a squeeze-out of non-tendering minority shareholders? Funding & Investment Amount Is the Equity Investment amount (€350m) sized based on the expected funding gap or any restrictions on your side? Which deployment criteria do you contemplate for the Additional Funding Instrument ($100m)? In case the free float does not tender in full, and the capital required is lower than €155m, will the remaining amount be available for additional funding of the company? For good order, can you confirm that you do not contemplate a minimum acceptance threshold in Due Diligence Based on engagement with management to date, what additional due diligence and specific documentation / confirmatory due diligence is needed to proceed to a binding proposal? Other than which advisors do you contemplate retaining? Governance & Exit Have you had any discussions with Meridiam around a co-control structure? What exit provisions would you contemplate to provide Meridiam with on exit channel? Are there particular co-control provisions you have in mind which you feel we should know now? Preferential Bidder Engagement Please elaborate on your expectation here? 7 Allego>

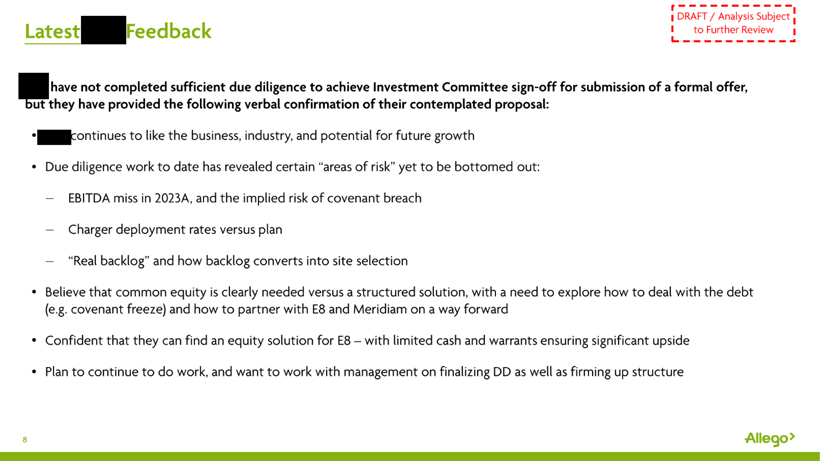

DRAFT / Analysis Subject to Further Review Latest Feedback have not completed sufficient due diligence to achieve Investment Committee sign-off for submission of a formal offer, but they have provided the following verbal confirmation of their contemplated proposal: • continues to like the business, industry, and potential for future growth • Due diligence work to date has revealed certain “areas of risk” yet to be bottomed out: EBITDA miss in 2023A, and the implied risk of covenant breach Charger deployment rates versus plan “Real backlog” and how backlog converts into site selection • Believe that common equity is clearly needed versus a structured solution, with a need to explore how to deal with the debt (e.g. covenant freeze) and how to partner with E8 and Meridiam on a way forward • Confident that they can find an equity solution for E8- with limited cash and warrants ensuring significant upside • Plan to continue to do work, and want to work with management on finalizing DD as well as firming up structure 8 Allego>

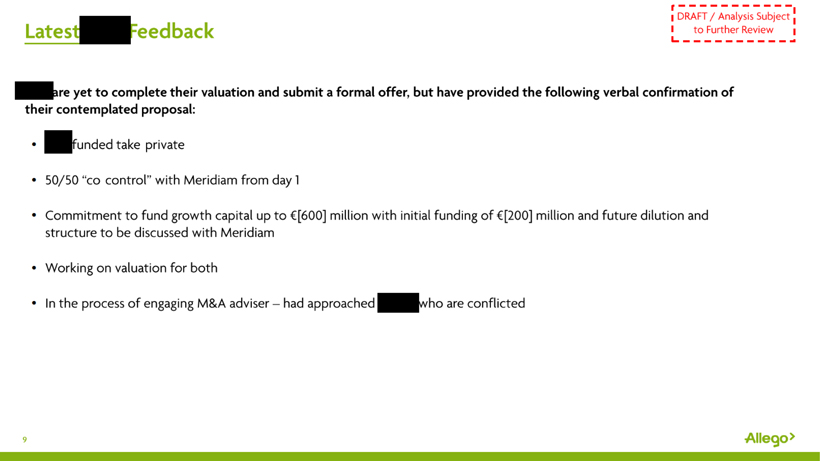

DRAFT / Analysis Subject to Further Review Latest Feedback are yet to complete their valuation and submit a formal offer, but have provided the following verbal confirmation of their contemplated proposal: funded take private 50/50 “co control” with Meridiam from day 1 Commitment to fund growth capital up to €[600] million with initial funding of €[200] million and future dilution and structure to be discussed with Meridiam Working on valuation for both In the process of engaging M&A adviser - had approached who are conflicted 9 Allego>

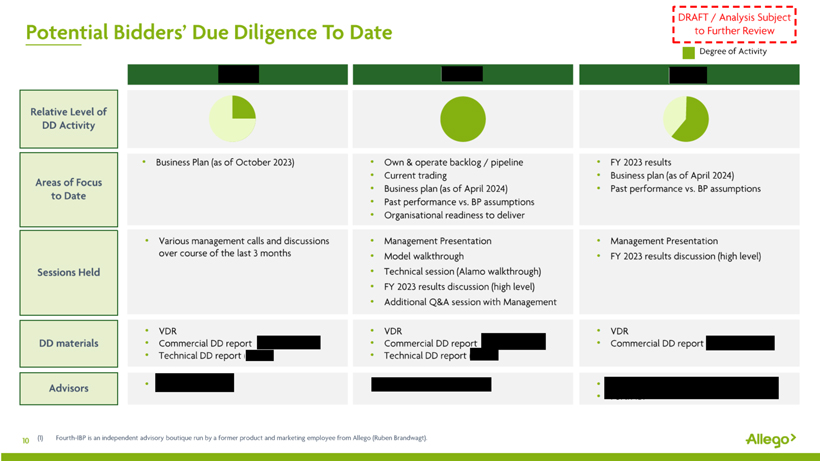

Potential Bidders’ Due Diligence To Date DRAFT / Analysis Subject to Further Review Degree of Activity Relative Level of DD Activity Areas of Focus to Date • Business Plan (as of October 2023) • Own & operate backlog / pipeline • Current trading • Business plan (as of April 2024) • Past performance vs. BP assumptions • Organisational readiness to deliver • FY 2023 results • Business plan (as of April 2024) • Past performance vs. BP assumptions Sessions Held • Various management calls and discussions over course of the last 3 months • Management Presentation • Model walkthrough • Technical session (Alamo walkthrough) FY 2023 results discussion (high level) • Additional Q&A session with Management • Management Presentation FY 2023 results discussion (high level) DD materials • VDR • Commercial DD report • Technical DD report • VDR • Commercial DD report • Technical DD report • VDR Commercial DD report Advisors (1) Forth-IBP is an independent advisory boutique run by a former product and marketing employee from Allego (Ruben Brandwagt). 10