Exhibit 99.2 Allego, a leading European public EV fast-charging network Enabling green electric mobility Fourth Quarter and Full Year 2022 Earnings Presentation

Disclaimer. All statements other than statements of historical facts contained in this presentation are forward-looking statements. Allego N.V. (“Allego”) intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,”, “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or other similar expressions (or the negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, without limitation, Allego’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially, and potentially adversely, from those expressed or implied in the forward-looking statements. Most of these factors are outside Allego’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (i) changes adversely affecting Allego’s business, (ii) the price and availability of electricity (iii) the risks associated with vulnerability to industry downturns and regional or national downturns, (iv) fluctuations in Allego’s revenue and operating results, (v) unfavorable conditions or further disruptions in the capital and credit markets, (vi) Allego’s ability to generate cash, service indebtedness and incur additional indebtedness, (vii) competition from existing and new competitors, (viii) the growth of the electric vehicle market, (ix) Allego’s ability to integrate any businesses it may acquire, (x) Allego’s ability to recruit and retain experienced personnel, (xi) risks related to legal proceedings or claims, including liability claims, (xii) Allego’s dependence on third-party contractors to provide various services, (xiii) Allego’s ability to obtain additional capital on commercially reasonable terms, (xiv) the impact of COVID-19, including COVID-19 and other related supply chain disruptions and expense increases, (xv) general economic, regulatory or political conditions, including the armed conflict in Ukraine and (xvi) other factors detailed under the section entitled “Risk Factors” of Allego’s filings with the U.S. Securities and Exchange Commission (SEC). The foregoing list of factors is not exclusive. If any of these risks materialize or Allego’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Allego presently does not know or that Allego currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Allego’s expectations, plans or forecasts of future events and views as of the date of this presentation. Allego anticipates that subsequent events and developments will cause Allego’s assessments to change. However, while Allego may elect to update these forward-looking statements at some point in the future, Allego specifically disclaims any obligation to do so, unless required by applicable law. These forward-looking statements should not be relied upon as representing Allego’s assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. INDUSTRY AND MARKET DATA Although all information and opinions expressed in this presentation, including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, Allego has not independently verified the information and makes no representation or warranty, express or implied, as to its accuracy or completeness. Some data is also based on the good faith estimates of Allego, which is derived from its review of internal sources as well as the independent sources described above. This presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your investment with Allego. FINANCIAL INFORMATION; NON-IFRS FINANCIAL MEASURES Some of the financial information and data contained in this presentation, such as EBITDA, Operational EBITDA and free cash flow, have not been prepared in accordance with Dutch generally accepted accounting principles, United States generally accepted accounting principles or the International Financial Reporting Standards (“IFRS”). We define (i) EBITDA as earnings before interest expense, taxes, depreciation and amortization, (ii) Operational EBITDA as EBITDA further adjusted for reorganization costs, certain business optimization costs, lease buyouts and transaction costs and (iii) free cash flow as net cash flow from operating activities less capital expenditures. Allego believes that the use of these non-IFRS measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Allego’s financial condition and results of operations. Allego’s management uses these non-IFRS measures for trend analyses, for purposes of determining management incentive compensation and for budgeting and planning purposes. Allego believes that the use of these non-IFRS financial measures provides an additional tool for investors to use in evaluating projected operating results and trends and in comparing Allego’s financial measures with other similar companies, many of which present similar non-IFRS financial measures to investors. Management does not consider these non-IFRS measures in isolation or as an alternative to financial measures determined in accordance with IFRS. The principal limitation of these non-IFRS financial measures is that they exclude significant expenses and income that are required by IFRS to be recorded in Allego’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-IFRS financial measures. In order to compensate for these limitations, management presents non-IFRS financial measures in connection with IFRS results and reconciliations to the most directly comparable IFRS measure are provided in the Appendix to this presentation . TRADEMARKS AND TRADE NAMES Allego owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Allego or an endorsement or sponsorship by or of Allego. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Allego will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks, service marks and trade names. CERTAIN RISKS RELATED TO ALLEGO All references to the “Company,” “Allego,” “we,” “us,” or “our” in this presentation refer to the business of Allego. The risks presented below are certain of the general risks related to Company’s business, industry and ownership structure and are not exhaustive. The list below is qualified in its entirety by disclosures contained in Allego’s filings with the U.S. Securities and Exchange Commission. These risks speak only as of the date of the presentation, and we have no obligation to update the disclosures contained herein. The risks highlighted in future filings with the SEC may differ significantly from and will be more extensive than those presented below. • Allego is an early-stage company with a history of operating losses and expects to incur significant expenses and continuing losses for the near term and medium term. • Allego has experienced rapid growth and expects to invest substantially in growth for the foreseeable future. If it fails to manage growth effectively, its business, operating results, and financial condition could be adversely affected. • Allego’s forecasts and projections are based upon assumptions, analyses, and internal estimates developed by Allego’s management. If these assumptions, analyses, or estimates prove to be incorrect or inaccurate, Allego’s actual operating results may differ adversely and materially from those forecasted or projected. • Allego’s estimates of market opportunity and forecasts of market growth may prove to be inaccurate. • Allego’s business is subject to risks associated with the price of electricity, which may hamper its profitability and growth. • Allego is dependent on the availability of electricity at its current and future charging sites. Delays and/or other restrictions on the availability of electricity (for example, grid connection delays) would adversely affect Allego’s business and results of operations. • Allego currently faces competition from a number of companies and expects to face significant competition in the future as the market for EV charging develops. • Allego’s future revenue growth will depend in significant part on its ability to increase the number and size of its charging sites, traffic, and the sales of services to B2B customers. • Allego may need to raise additional funds or debt and these funds may not be available when needed. • If Allego fails to offer high-quality support to its customers and fails to maintain the availability of its charging points, its business and reputation may suffer. • Allego relies on a limited number of suppliers and manufacturers for its hardware and equipment and charging stations. A loss of any of these partners or issues in their manufacturing and supply processes could negatively affect its business. TM • Allego’s EV driver base will depend upon the effective operation of Allego’s EVCloud platform and its applications with mobile service providers, firmware from hardware manufacturers, mobile operating systems, payment systems, networks and standards that Allego does not control. • If Allego is unable to attract and retain key employees and hire qualified management, technical, engineering and sales personnel, its ability to compete and successfully grow its business would be harmed. • Allego is expanding operations in many countries in Europe, which will expose it to additional tax, compliance, market, local rules and other risks. • New alternative fuel technologies may negatively impact the growth of the EV market and thus the demand for Allego’s charging stations and services. • The European EV market currently benefits from the availability of rebates, scrappage schemes, tax credits and other financial incentive schemes from governments to offset and incentivize the purchase of EVs. The reduction, modification, or elimination of such benefits could cause reduced demand for EVs and EV charging, which would adversely affect Allego’s financial results. • Allego’s business may be adversely affected if it is unable to protect its technology and intellectual property from unauthorized use by third parties. • Computer malware, viruses, ransomware, hacking, phishing attacks and similar disruptions could result in security and privacy breaches and interruption in service, which could harm Allego’s business. • Allego’s technology could have undetected defects, errors or bugs in hardware or software which could reduce market adoption, damage its reputation with current or prospective customers, and/or expose it to product liability and other claims that could materially and adversely affect its business. • Allego has identified, and has previously identified, material weaknesses in its internal control over financial reporting. If Allego is unable to remediate these material weaknesses, or if Allego identifies additional material weaknesses in the future or otherwise fails to maintain an effective system of internal control over financial reporting, this may result in material misstatements contained within Allego’s consolidated financial statements or cause Allego to fail to meet its periodic reporting obligations. • Members of Allego’s management have limited experience in operating a public company. • Future sales, or the perception of future sales, of Allego’s Ordinary Shares and Warrants by Allego or selling security holders, including Madeleine Charging B.V., could cause the market price for Allego Ordinary Shares and Warrants to decline significantly. • Madeleine Charging B.V. owns a significant amount of Allego’s voting shares and its interests may conflict with those of other shareholders. 2

Overview & Key Highlights Mathieu Bonnet, CEO 3

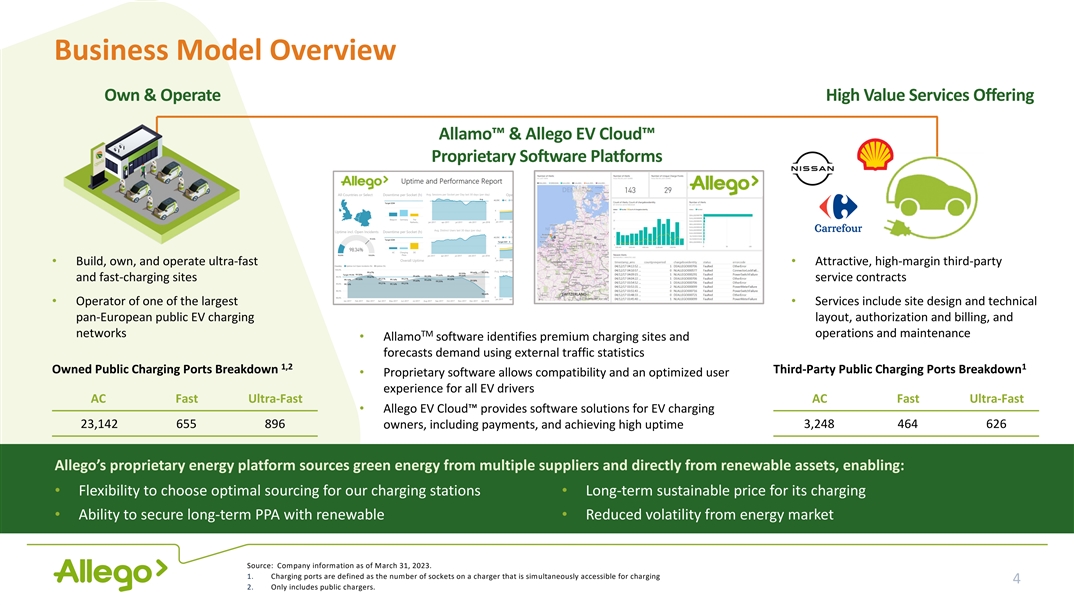

Business Model Overview Own & Operate High Value Services Offering Allamo™ & Allego EV Cloud™ Proprietary Software Platforms • Build, own, and operate ultra-fast • Attractive, high-margin third-party and fast-charging sites service contracts • Operator of one of the largest • Services include site design and technical pan-European public EV charging layout, authorization and billing, and networks TM operations and maintenance • Allamo software identifies premium charging sites and forecasts demand using external traffic statistics 1,2 1 Owned Public Charging Ports Breakdown Third-Party Public Charging Ports Breakdown • Proprietary software allows compatibility and an optimized user experience for all EV drivers AC Fast Ultra-Fast AC Fast Ultra-Fast • Allego EV Cloud™ provides software solutions for EV charging 23,142 655 896 3,248 464 626 owners, including payments, and achieving high uptime Allego’s proprietary energy platform sources green energy from multiple suppliers and directly from renewable assets, enabling: • Flexibility to choose optimal sourcing for our charging stations • Long-term sustainable price for its charging • Ability to secure long-term PPA with renewable • Reduced volatility from energy market Source: Company information as of March 31, 2023. 1. Charging ports are defined as the number of sockets on a charger that is simultaneously accessible for charging 4 2. Only includes public chargers.

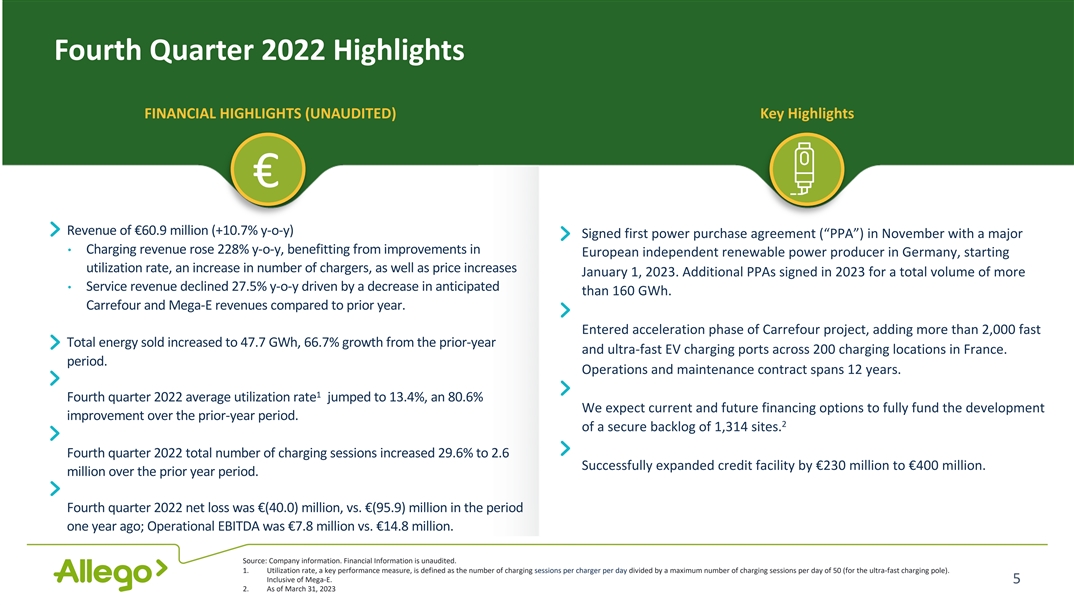

Fourth Quarter 2022 Highlights FINANCIAL HIGHLIGHTS (UNAUDITED) Key Highlights € Revenue of €60.9 million (+10.7% y-o-y) Signed first power purchase agreement (“PPA”) in November with a major • Charging revenue rose 228% y-o-y, benefitting from improvements in European independent renewable power producer in Germany, starting utilization rate, an increase in number of chargers, as well as price increases January 1, 2023. Additional PPAs signed in 2023 for a total volume of more • Service revenue declined 27.5% y-o-y driven by a decrease in anticipated than 160 GWh. Carrefour and Mega-E revenues compared to prior year. Entered acceleration phase of Carrefour project, adding more than 2,000 fast Total energy sold increased to 47.7 GWh, 66.7% growth from the prior-year and ultra-fast EV charging ports across 200 charging locations in France. period. Operations and maintenance contract spans 12 years. 1 Fourth quarter 2022 average utilization rate jumped to 13.4%, an 80.6% We expect current and future financing options to fully fund the development improvement over the prior-year period. 2 of a secure backlog of 1,314 sites. Fourth quarter 2022 total number of charging sessions increased 29.6% to 2.6 Successfully expanded credit facility by €230 million to €400 million. million over the prior year period. Fourth quarter 2022 net loss was €(40.0) million, vs. €(95.9) million in the period one year ago; Operational EBITDA was €7.8 million vs. €14.8 million. Source: Company information. Financial Information is unaudited. 1. Utilization rate, a key performance measure, is defined as the number of charging sessions per charger per day divided by a maximum number of charging sessions per day of 50 (for the ultra-fast charging pole). Inclusive of Mega-E. 5 2. As of March 31, 2023

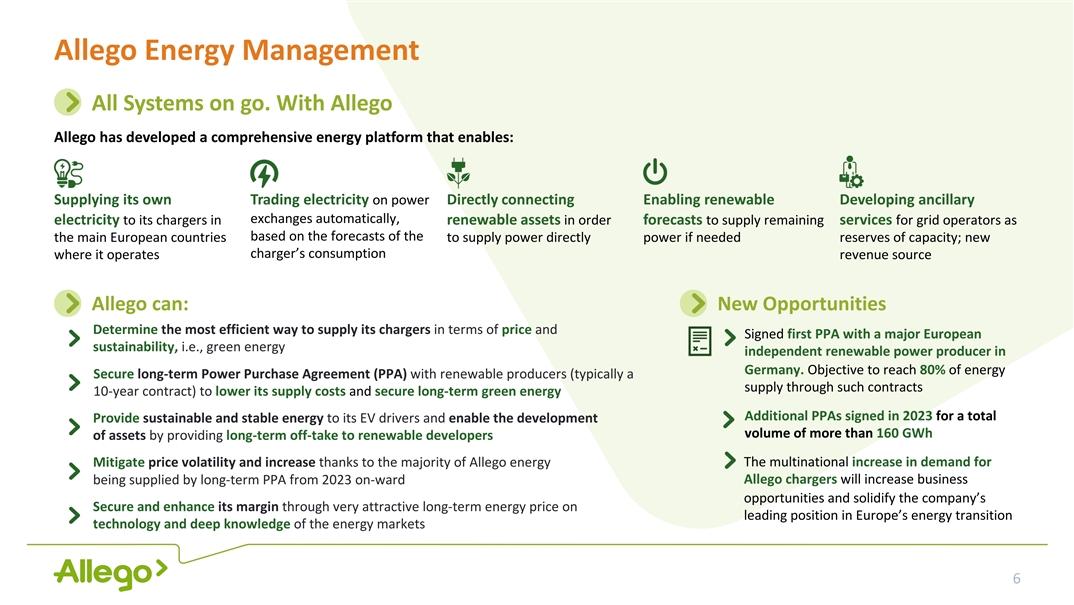

Allego Energy Management All Systems on go. With Allego Allego has developed a comprehensive energy platform that enables: Supplying its own Trading electricity on power Directly connecting Enabling renewable Developing ancillary exchanges automatically, electricity to its chargers in renewable assets in order forecasts to supply remaining services for grid operators as based on the forecasts of the the main European countries to supply power directly power if needed reserves of capacity; new charger’s consumption where it operates revenue source Allego can: New Opportunities Determine the most efficient way to supply its chargers in terms of price and Signed first PPA with a major European sustainability, i.e., green energy independent renewable power producer in Germany. Objective to reach 80% of energy Secure long-term Power Purchase Agreement (PPA) with renewable producers (typically a supply through such contracts 10-year contract) to lower its supply costs and secure long-term green energy Additional PPAs signed in 2023 for a total Provide sustainable and stable energy to its EV drivers and enable the development volume of more than 160 GWh of assets by providing long-term off-take to renewable developers Mitigate price volatility and increase thanks to the majority of Allego energy The multinational increase in demand for Allego chargers will increase business being supplied by long-term PPA from 2023 on-ward opportunities and solidify the company’s Secure and enhance its margin through very attractive long-term energy price on leading position in Europe’s energy transition technology and deep knowledge of the energy markets 6

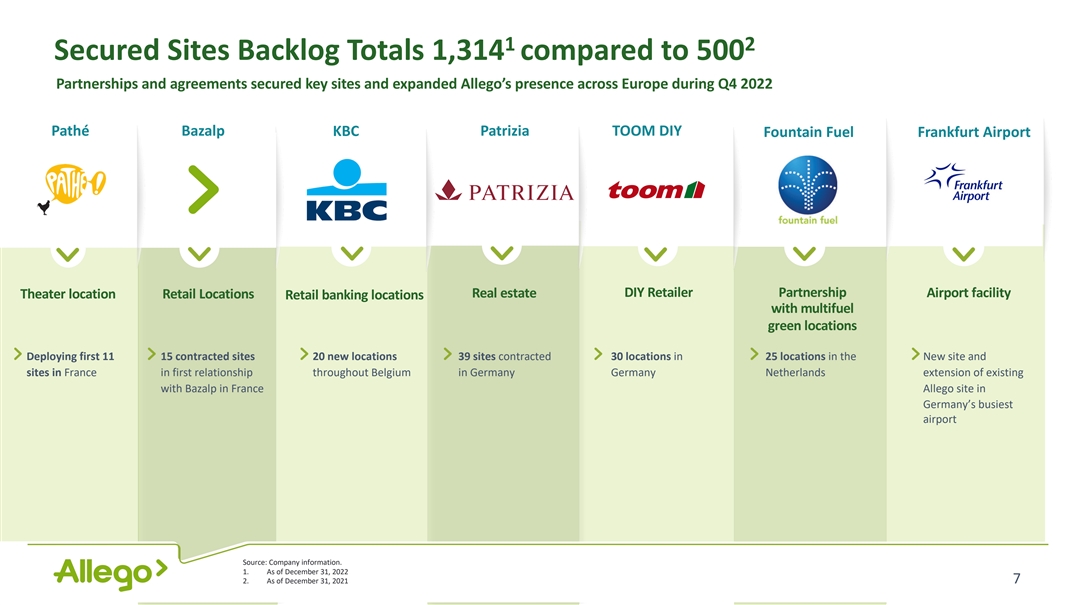

1 2 Secured Sites Backlog Totals 1,314 compared to 500 Partnerships and agreements secured key sites and expanded Allego’s presence across Europe during Q4 2022 Pathé Bazalp KBC Patrizia TOOM DIY Fountain Fuel Frankfurt Airport Real estate DIY Retailer Partnership Airport facility Theater location Retail Locations Retail banking locations with multifuel green locations Deploying first 11 15 contracted sites 20 new locations 39 sites contracted 30 locations in 25 locations in the New site and sites in France in first relationship throughout Belgium in Germany Germany Netherlands extension of existing with Bazalp in France Allego site in Germany’s busiest airport Source: Company information. 1. As of December 31, 2022 2. As of December 31, 2021 7

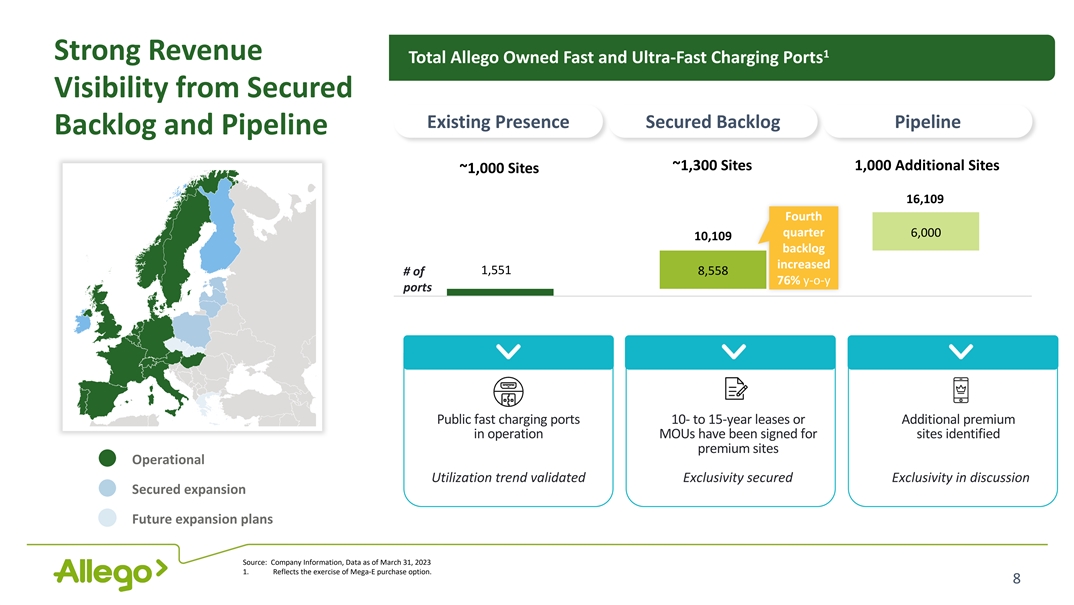

1 Strong Revenue Total Allego Owned Fast and Ultra-Fast Charging Ports Visibility from Secured Existing Presence Secured Backlog Pipeline Backlog and Pipeline ~1,300 Sites 1,000 Additional Sites ~1,000 Sites 16,109 Fourth quarter 6,000 10,109 backlog increased 1,551 8,558 # of 76% y-o-y ports Public fast charging ports 10- to 15-year leases or Additional premium in operation MOUs have been signed for sites identified premium sites Operational Utilization trend validated Exclusivity secured Exclusivity in discussion Secured expansion Future expansion plans Source: Company Information, Data as of March 31, 2023 1. Reflects the exercise of Mega-E purchase option. 8

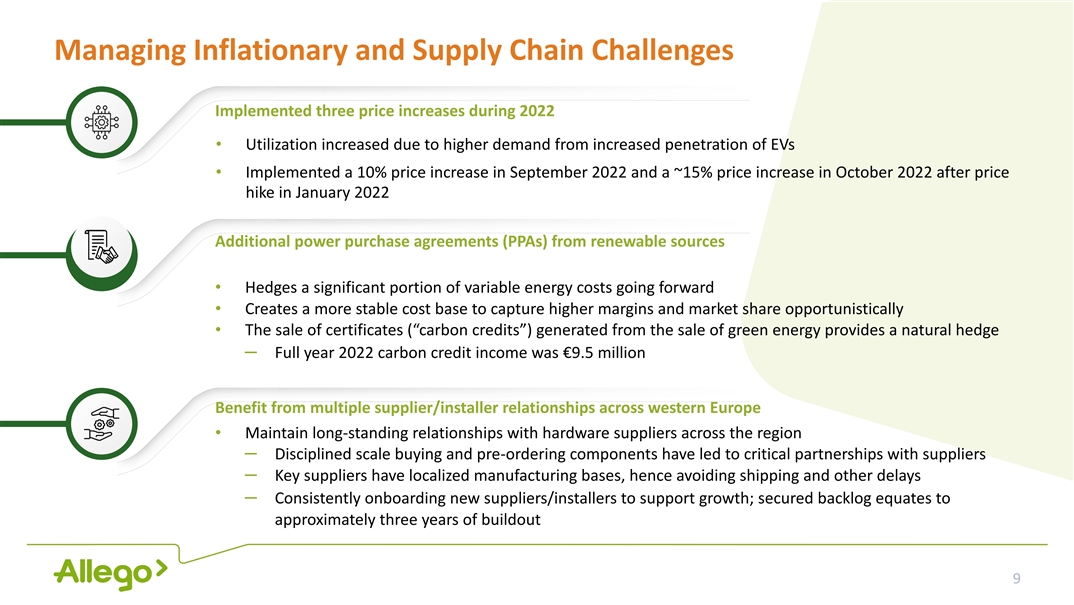

Managing Inflationary and Supply Chain Challenges Implemented three price increases during 2022 • Utilization increased due to higher demand from increased penetration of EVs • Implemented a 10% price increase in September 2022 and a ~15% price increase in October 2022 after price hike in January 2022 Additional power purchase agreements (PPAs) from renewable sources • Hedges a significant portion of variable energy costs going forward • Creates a more stable cost base to capture higher margins and market share opportunistically • The sale of certificates (“carbon credits”) generated from the sale of green energy provides a natural hedge – Full year 2022 carbon credit income was €9.5 million Benefit from multiple supplier/installer relationships across western Europe • Maintain long-standing relationships with hardware suppliers across the region – Disciplined scale buying and pre-ordering components have led to critical partnerships with suppliers – Key suppliers have localized manufacturing bases, hence avoiding shipping and other delays – Consistently onboarding new suppliers/installers to support growth; secured backlog equates to approximately three years of buildout 9

Financials Ton Louwers, CFO 10

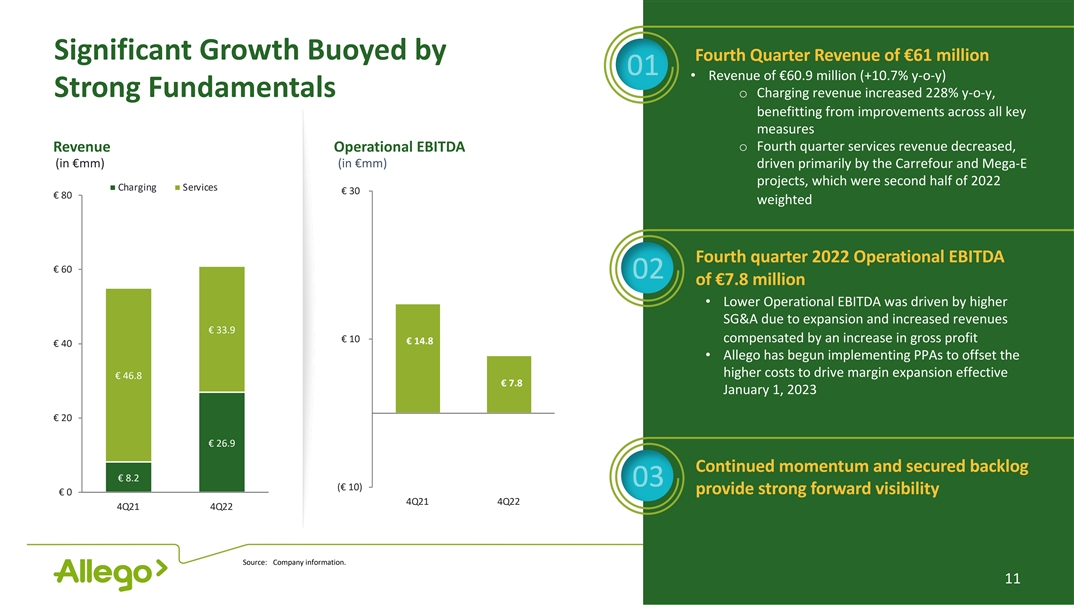

Significant Growth Buoyed by Fourth Quarter Revenue of €61 million • Revenue of €60.9 million (+10.7% y-o-y) Strong Fundamentals o Charging revenue increased 228% y-o-y, benefitting from improvements across all key measures o Fourth quarter services revenue decreased, Revenue Operational EBITDA (in €mm) (in €mm) driven primarily by the Carrefour and Mega-E projects, which were second half of 2022 Charging Services € 30 € 80 weighted Fourth quarter 2022 Operational EBITDA € 60 of €7.8 million • Lower Operational EBITDA was driven by higher SG&A due to expansion and increased revenues € 33.9 € 10 compensated by an increase in gross profit € 14.8 € 40 • Allego has begun implementing PPAs to offset the higher costs to drive margin expansion effective € 46.8 € 7.8 January 1, 2023 € 20 € 26.9 Continued momentum and secured backlog € 8.2 (€ 10) provide strong forward visibility € 0 4Q21 4Q22 4Q21 4Q22 Source: Company information. 11

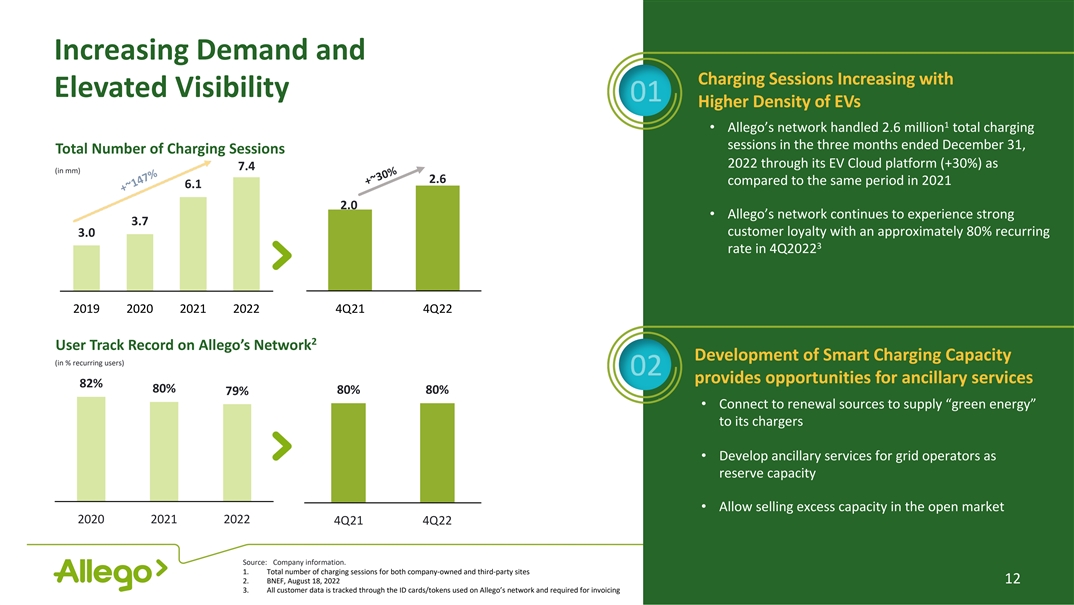

Increasing Demand and Charging Sessions Increasing with Elevated Visibility Higher Density of EVs 1 • Allego’s network handled 2.6 million total charging sessions in the three months ended December 31, Total Number of Charging Sessions 2022 through its EV Cloud platform (+30%) as 7.4 (in mm) 2.6 compared to the same period in 2021 6.1 2.0 • Allego’s network continues to experience strong 3.7 customer loyalty with an approximately 80% recurring 3.0 3 rate in 4Q2022 2019 2020 2021 2022 4Q21 4Q22 2 User Track Record on Allego’s Network Development of Smart Charging Capacity (in % recurring users) provides opportunities for ancillary services 82% 80% 80% 80% 79% • Connect to renewal sources to supply “green energy” to its chargers • Develop ancillary services for grid operators as reserve capacity • Allow selling excess capacity in the open market 2020 2021 2022 4Q21 4Q22 Source: Company information. 1. Total number of charging sessions for both company-owned and third-party sites 2. BNEF, August 18, 2022 12 3. All customer data is tracked through the ID cards/tokens used on Allego’s network and required for invoicing +~30% +~147%

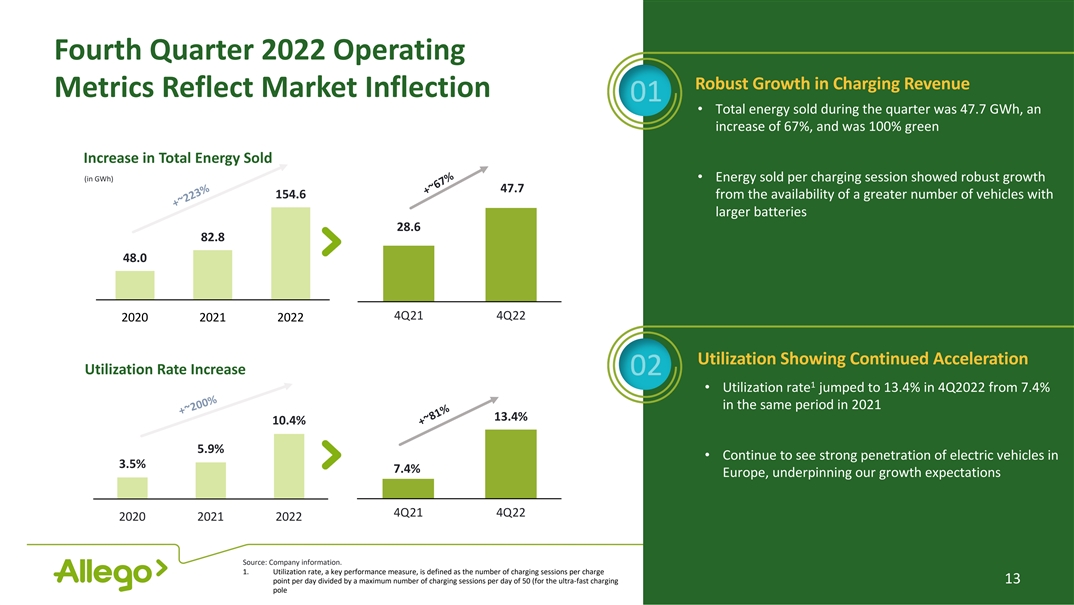

Fourth Quarter 2022 Operating Robust Growth in Charging Revenue Metrics Reflect Market Inflection • Total energy sold during the quarter was 47.7 GWh, an increase of 67%, and was 100% green Increase in Total Energy Sold (in GWh) • Energy sold per charging session showed robust growth 47.7 154.6 from the availability of a greater number of vehicles with larger batteries 28.6 82.8 48.0 4Q21 4Q22 2020 2021 2022 Utilization Showing Continued Acceleration Utilization Rate Increase 1 • Utilization rate jumped to 13.4% in 4Q2022 from 7.4% in the same period in 2021 13.4% 10.4% 5.9% • Continue to see strong penetration of electric vehicles in 3.5% 7.4% Europe, underpinning our growth expectations 4Q21 4Q22 2020 2021 2022 Source: Company information. 1. Utilization rate, a key performance measure, is defined as the number of charging sessions per charge point per day divided by a maximum number of charging sessions per day of 50 (for the ultra-fast charging 13 pole +~200% +~223% +~81% +~67%

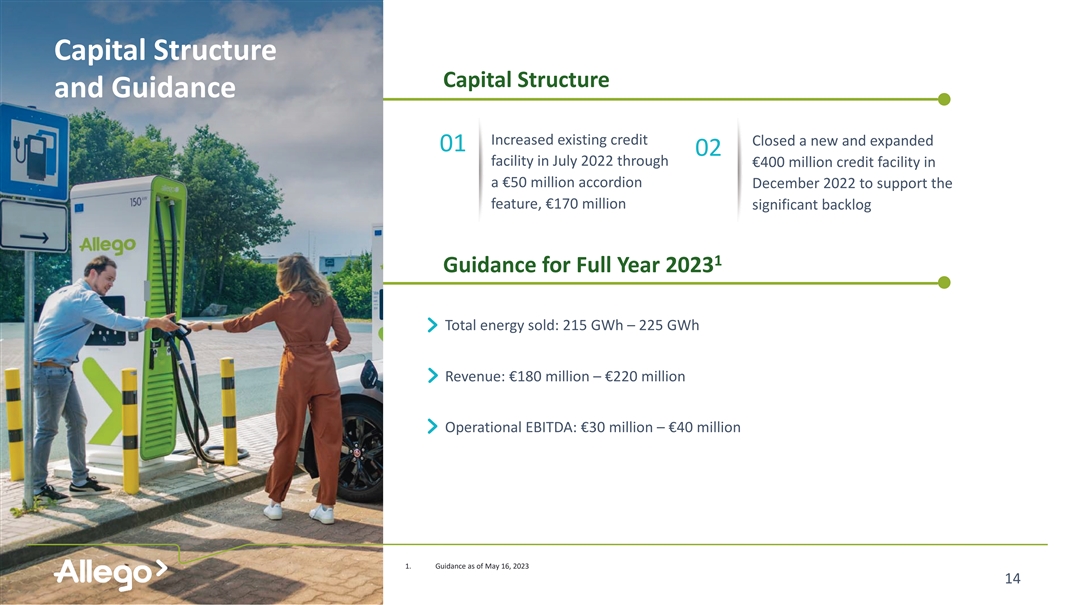

Capital Structure Capital Structure and Guidance Increased existing credit Closed a new and expanded 01 02 facility in July 2022 through €400 million credit facility in a €50 million accordion December 2022 to support the feature, €170 million significant backlog 1 Guidance for Full Year 2023 Total energy sold: 215 GWh – 225 GWh Revenue: €180 million – €220 million Operational EBITDA: €30 million – €40 million 1. Guidance as of May 16, 2023 14

Appendix Financial Statements Reconciliation 15

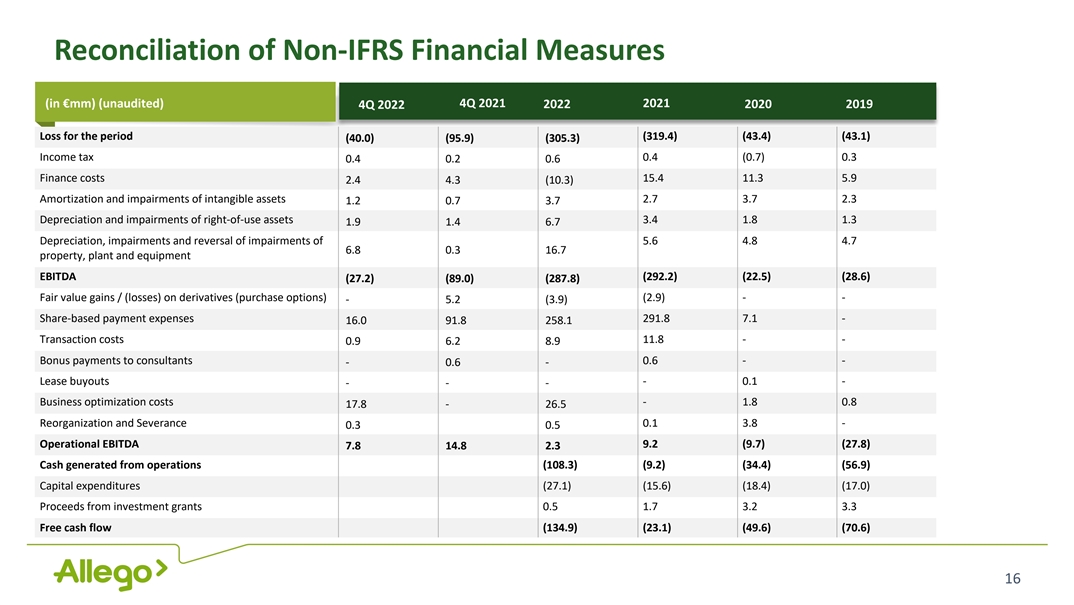

Reconciliation of Non-IFRS Financial Measures (in €mm) (unaudited) 4Q 2021 2022 2021 2020 2019 4Q 2022 Loss for the period (319.4) (43.4) (43.1) (40.0) (95.9) (305.3) Income tax 0.4 (0.7) 0.3 0.4 0.2 0.6 Finance costs 15.4 11.3 5.9 2.4 4.3 (10.3) Amortization and impairments of intangible assets 2.7 3.7 2.3 1.2 0.7 3.7 Depreciation and impairments of right-of-use assets 3.4 1.8 1.3 1.9 1.4 6.7 Depreciation, impairments and reversal of impairments of 5.6 4.8 4.7 6.8 0.3 16.7 property, plant and equipment EBITDA (292.2) (22.5) (28.6) (27.2) (89.0) (287.8) Fair value gains / (losses) on derivatives (purchase options) (2.9) - - - 5.2 (3.9) Share-based payment expenses 291.8 7.1 - 16.0 91.8 258.1 Transaction costs 11.8 - - 0.9 6.2 8.9 Bonus payments to consultants 0.6 - - - 0.6 - Lease buyouts - 0.1 - - - - Business optimization costs - 1.8 0.8 17.8 - 26.5 Reorganization and Severance 0.1 3.8 - 0.3 0.5 Operational EBITDA 9.2 (9.7) (27.8) 7.8 14.8 2.3 Cash generated from operations (108.3) (9.2) (34.4) (56.9) Capital expenditures (27.1) (15.6) (18.4) (17.0) Proceeds from investment grants 0.5 1.7 3.2 3.3 Free cash flow (134.9) (23.1) (49.6) (70.6) 16

17