The information in this preliminary prospectus is not complete and may be changed. The selling securityholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 30, 2022

PRELIMINARY PROSPECTUS

Allego N.V.

13,799,948 ORDINARY SHARES

Offered by Allego N.V.

66,493,170 ORDINARY SHARES

Offered by Selling Securityholders

This prospectus relates to the issuance by us of up to 13,799,948 ordinary shares, with a nominal value of € 0.12 per share (“Ordinary Shares”) of Allego N.V., a public limited liability company (naamloze vennotschap) governed by the laws of the Netherlands (“Allego”), that are issuable upon the exercise of 13,799,948 Warrants to purchase Ordinary Shares, which were originally Public Warrants (as defined below) issued in the initial public offering of units of Spartan Acquisition Corp. III (“Spartan”) at a price of $10.00 per unit, with each unit consisting of one share of Class A common stock and one-fourth of one Public Warrant. See “Prospectus Summary—Recent Developments—Business Combination.”

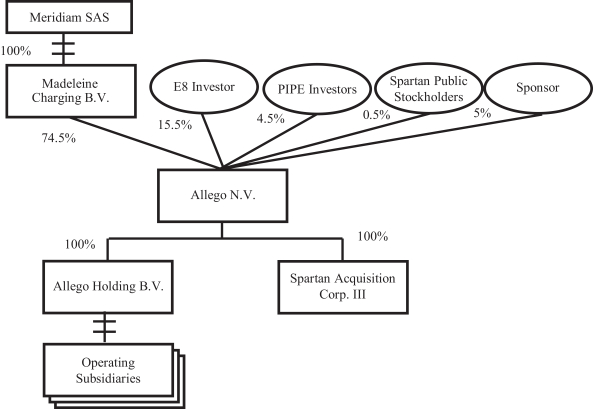

This prospectus also relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”), or their permitted transferees, of up to 66,493,170 Ordinary Shares (the “Total Resale Shares”), which includes (i) 13,700,000 Ordinary Shares that were issued in exchange for Spartan Founders Stock, originally purchased at a price of approximately $0.002 per share, upon the closing of the Business Combination (the “Business Combination”), (ii) 10,360,227 Ordinary Shares issued to a limited number of qualified institutional buyers and institutional and individual accredited investors (the “Private Placement Investors”) at a price of $10.00 per Ordinary Share on the closing of the Business Combination, (iii) 41,097,994 Ordinary Shares that were issued in exchange for Allego Holding Shares (as defined below) to the E8 Investor (as defined below) as compensation under the Special Fees Agreement (as defined below), based on a value of Allego and its subsidiaries of $10.00 per share, upon the closing of the Business Combination and (iv) 1,334,949 Ordinary Shares that were issued to AP Spartan Energy Holdings III (PPW), LLC (“AP PPW”) at a price of $11.50 per share on a cashless exercise basis upon its exercise of 9,360,000 Warrants to purchase Ordinary Shares, which were originally Private Placement Warrants purchased at a price of $1.50 per Private Placement Warrant that were automatically converted into Warrants upon the closing of the Business Combination. See “Prospectus Summary—Recent Developments—Business Combination.”

Each Warrant entitles the holder thereof to purchase one Ordinary Share at a price of $11.50 per share. We will receive proceeds from the exercise of the Warrants to the extent the Warrants are exercised for cash, which amount of aggregate proceeds, assuming the exercise of all Warrants, could be up to $158,699,402. We believe the likelihood that Warrant holders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than $11.50 per share, we believe the Warrant holders will be less likely to exercise their Warrants. We will not receive any proceeds from the sale of Ordinary Shares by the Selling Securityholders pursuant to this prospectus. However, we will pay the expenses, other than underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities, associated with the sale of Ordinary Shares pursuant to this prospectus.

Our registration of the Ordinary Shares covered by this prospectus does not mean that either we or the Selling Securityholders will offer or sell, as applicable, any of the Ordinary Shares. The Selling Securityholders may offer and sell the Ordinary Shares covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the Ordinary Shares in the section entitled “Plan of Distribution.”

Madeleine Charging B.V., a Dutch private limited liability company (“Madeleine”), our majority shareholder, owns approximately 74.1% of our Ordinary Shares and has the right to direct the voting of an additional approximately 15.4% of our outstanding Ordinary Shares, pursuant to an irrevocable voting power of attorney granted by another investor in our company. As a result, Madeleine controls matters requiring shareholder or board approval, including the election of directors. Accordingly, we are a “controlled company” under New York Stock Exchange (“NYSE”) corporate governance rules and are eligible for certain exemptions from these rules. We are a “foreign private issuer” under applicable Securities and Exchange Commission rules and an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and are eligible for reduced public company disclosure requirements.

Our Ordinary Shares and Warrants are listed on the NYSE under the symbols “ALLG” and “ALLG.WS,” respectively. On September 29 2022, the last reported sale price of our Ordinary Shares was $4.52 per share and the last reported sale price of our Warrants was $4.52.

Prior to the extraordinary meeting of Spartan in connection with the Business Combination, holders of 54,092,418 shares of Spartan Class A Common Stock exercised their right to redeem those shares for cash at a price of approximately $10.00 per share, for an aggregate of $540,984,673, which represented approximately 97.99% of the total Spartan Common Stock then outstanding. The Total Resale Shares being offered for resale in this prospectus represent approximately 24.9% of our current total outstanding Ordinary Shares. The Total Resale Shares represent a substantial percentage of our total outstanding Ordinary Shares as of the date of this prospectus. The sale of all securities being offered in this prospectus could result in a significant decline in the public trading price of our Ordinary Shares. Despite such a decline in the public trading price, the Selling Securityholders may still experience a positive rate of return on the securities they purchased due to the difference in the purchase prices described above. Based on the closing price of our Ordinary Shares referenced above, (a) the holders of Ordinary Shares that were issued in exchange for Spartan Founders Stock may experience potential profit of up to $4.52 per Ordinary Share. The Private Placement Investors and the E8 Investor will only experience a profit if the sale price of the Ordinary Shares exceeds $10.00 per share and AP PPW will only experience a profit if the sale price of the Ordinary Shares exceeds $13.00 per share. Even though the current trading price of the Ordinary Shares is close to the price at which the units were issued in Spartan’s initial public offering, the Selling Securityholders may have an incentive to sell because they may still experience a positive rate of return based on the current trading price. The public securityholders may not experience a similar rate of return on the securities they purchase due to differences in the purchase prices and the current trading price.

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities. Investing in the Company’s securities involves risks. See “Risk Factors” beginning on page 14 of this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED , 2022