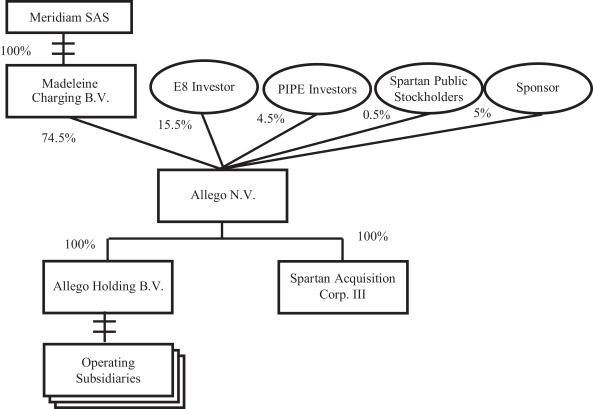

Corporate Structure

The following simplified diagram illustrates the ownership structure of Allego immediately following the consummation of the Business Combination (note that the horizontal dashes indicate additional legal entities that have been omitted for the sake of simplicity).

Corporate Information

Allego was formed under the laws of the Netherlands in 2021 as a public limited liability company (). The mailing address of Allego’s registered office is Westervoortsedijk 73 KB, 6827 AV Arnhem, the Netherlands, and Allego’s phone number is +31(0)88 033 3033. Allego’s principal website address is www.allego.eu. We do not incorporate the information contained on, or accessible through, Allego’s websites into this prospectus, and you should not consider it as a part of this prospectus. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is www.sec.gov.

naamloze vennotschap

6