ITEM 4. |

INFORMATION ON THE COMPANY |

A. History and Development of the Company

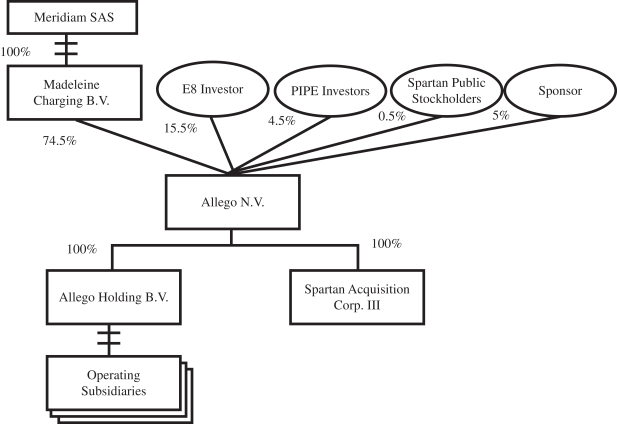

Athena Pubco B.V. was incorporated pursuant to Dutch law on June 3, 2021 for the purpose of effectuating the Business Combination and, following the consummation of the Business Combination on March 16, 2022, Allego was redesignated as Allego N.V. and became the parent company of the combined business. In connection with the Business Combination, the Allego Articles were amended and Allego changed its legal form from a Dutch private liability company () to a Dutch public liability company (). See “” for further details regarding the Business Combination. See “” for a discussion of Allego’s principal capital expenditures and divestitures.

besloten vennootschap met beperkteaansprakelijkheid

naamloze vennootschap

Explanatory Note

Item 5. Operating and Financial Review and Prospects

The mailing address of Allego’s registered office is Westervoortsedijk 73 KB, 6827 AV Arnhem, the Netherlands, and Allego’s phone number is +31(0)88 033 3033. Allego’s principal website address is www.allego.com. We do not incorporate the information contained on, or accessible through, Allego’s websites into this Annual Report, and you should not consider it as a part of this Annual Report. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is www.sec.gov.

B. Business Overview

Allego operates one of the largest

pan-European

electric vehicle EV public charging networks and is a provider of high value-add

EV charging services to third-party customers. Its large, vehicle-agnostic European public network offers easy access for all EV car, truck and bus drivers. As of December 31, 2021, Allego owns or operates more than 31,000 public charging ports and 16,000 public and private sites across 14 countries and has over 672,000 unique network users, 80% of which are recurring users as of December 31, 2021. In addition, it provides a wide variety of EV-related

services including site design and technical layout, authorization and billing, and operations and maintenance to more than 400 customers that include fleets and corporations, charging hosts, OEMs, and municipalities. Founded in 2013, Allego is a leading EV charging company in Europe with its first fast charger becoming operational soon after founding and deploying Europe’s first ultra-fast charging station in 2017. From its inception, Allego has focused on EV charging solutions that can be accessed by the highest number of vehicles, regardless of vehicle type or OEM, thus allowing it to grow in a vehicle-agnostic manner.

Allego believes its business is set to expand quickly with the growth of transportation electrification and that its growth could potentially exceed the industry-wide anticipated four-times growth of the number of EVs from 2020 to 2025, according to a report entitled “Electric Vehicle Outlook 2020” by BloombergNEF (“ ”), a strategic research provider covering global commodity markets and disruptive technologies. The European EV market is larger and growing faster than the U.S. market, according to Allego’s estimates, due to

BNEF

Report

32