“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of

1976.

“Intellectual Property” means (i) patents, patent applications and patent disclosures, together with

all reissues, continuations, continuations-in-part, divisionals, revisions, extensions or reexaminations thereof, (ii) trademarks and service marks, trade dress,

logos, trade names, corporate names, brands, slogans, and other source identifiers together with all translations, adaptations, derivations, combinations and other variants of the foregoing, and all applications, registrations, and renewals in

connection therewith, together with all of the goodwill associated with the foregoing, (iii) copyrights, and other works of authorship (whether or not copyrightable), and moral rights, and registrations and applications for registration,

renewals and extensions thereof, (iv) trade secrets, know-how (including ideas, formulas, compositions, inventions (whether or not patentable or reduced to practice)), and database rights,

(v) Internet domain names and social media accounts, (vi) rights of publicity and all other intellectual property or proprietary rights of any kind or description, and (vii) all legal rights arising from items (i) through (vi),

including the right to prosecute, enforce and perfect such interests and rights to sue, oppose, cancel, interfere, enjoin and collect damages based upon such interests, including such rights based on past infringement, if any, in connection with any

of the foregoing.

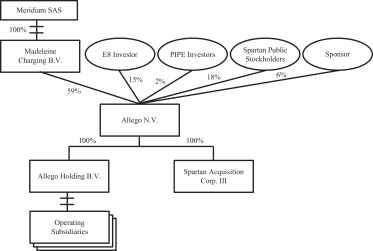

“Irrevocable Voting POA and Prior Consent Agreement” means that certain Irrevocable Voting POA

and Prior Consent Agreement, by and between the Company and E8 Investor, dated as of April 14, 2021.

“IRS”

means the U.S. Internal Revenue Service.

“ITEPA” means the United Kingdom Income Tax (Earnings and Pensions) Act

of 2003.

“knowledge” or “to the knowledge” of a person means (i) in the case of the

Company, the actual knowledge of the persons listed on Schedule A after reasonable inquiry of the individuals with operational responsibility for the fact or matter in question, (ii) in the case of Spartan, the actual

knowledge of Geoffrey Strong, James Crossen, Olivia Wassenaar, Joseph Romeo and Corinne Still after reasonable inquiry, and (iii) in the case of Madeleine Charging, the actual knowledge of the persons listed on Schedule B after

reasonable inquiry.

“Law” means any federal, national, state, county, municipal, provincial, local, foreign or

multinational, statute, constitution, common law, ordinance, code, decree, order, judgment, rule, regulation, ruling, requirement or mandatory collective bargaining agreement issued, enacted, adopted, promulgated, implemented or otherwise put into

effect by or under the authority of any Governmental Authority.

“Leased Real Property” means the real property

leased by the Company or Company Subsidiaries as tenant, together with, to the extent leased by the Company or Company Subsidiaries, all buildings and other structures, facilities or improvements located thereon and all easements, licenses, rights

and appurtenances of the Company or Company Subsidiaries relating to the foregoing, for which the Company or any Company Subsidiary is required to make aggregate payments in excess of $200,000 annually.

“Lien” means any lien, security interest, mortgage, pledge, adverse claim or other encumbrance of any kind that

secures the payment or performance of an obligation (other than those created under applicable securities laws).

“NewCo

Ordinary Share” means the shares in the capital of NewCo, with a nominal value of twelve euro cents (EUR 0.12) each.

“Open Source Software” means any Software in source code form that is licensed pursuant to (i) any license that

is a license approved by the open source initiative and listed at http://www.opensource.org/licenses, which licenses include all versions of the GNU General Public License (GPL), the GNU Lesser General Public License (LGPL), the GNU Affero GPL, the

MIT license, the Eclipse Public License, the Common Public

A-8