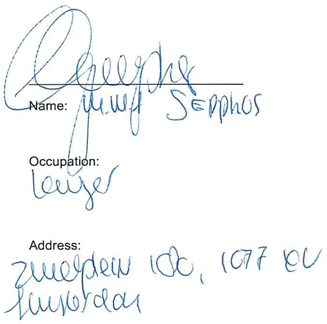

SIGNATURES

| The Debtors |

| ALLEGO B.V. |

| Signed as a deed by Allego B.V., a company incorporated in the Netherlands, by

|

| who, in accordance with the laws of that territory, is acting under the authority of the company |

|

Exhibit 10.15

PARALLEL DEBT AGREEMENT

dated 27 May 2019

ALLEGO B.V.

ALLEGO INNOVATIONS B.V.

ALLEGO HOLDING B.V.

as Debtors

SOCIETE GENERALE

as Agent

SOCIETE GENERALE

as Security Agent

ALLEGO CHARGING LTD

as service of process agent for the Debtors

Linklaters

Ref: L-277024

Linklaters LLP

THIS AGREEMENT is dated 27 May 2019 and made between:

| (1) | ALLEGO HOLDING B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) under the laws of the Netherlands, having its official seat (statutaire zetel) in Arnhem, the Netherlands, and its office at Westervoortsedijk 73 LB1, 6827 AV Arnhem, the Netherlands, registered with the Dutch Trade Register under number 73283754, acting as holdco, and an original debtor (the “Holdco”); |

ALLEGO B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) under the laws of the Netherlands, having its official seat (statutaire zetel) in Arnhem, the Netherlands, and its office at Westervoortsedijk 73 LB1, 6827 AV Arnhem, the Netherlands, registered with the Dutch Trade Register under number 54100038, acting as an original debtor; and

ALLEGO INNOVATIONS B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) under the laws of the Netherlands, having its official seat (statutaire zetel) in Arnhem, the Netherlands, and its office at Westervoortsedijk 73 LB1,6827 AV Arnhem, the Netherlands, registered with the Dutch Trade Register under number 73289655, acting as an original debtor,

(together, the “Original Debtors”);

| (2) | SOCIÉTÉ GÉNÉRALE, société anonyme incorporated under the laws of France, having its registered seat located at 29 boulevard Haussmann, 75009 Paris, France and registered with the trade and companies registry (registre du commerce et des sociétés) of Paris under number 552 120 222, as agent (the “Agent”); |

| (3) | SOCIÉTÉ GÉNÉRALE, société anonyme incorporated under the laws of France, having its registered seat located at 29 boulevard Haussmann, 75009 Paris, France and registered with the trade and companies registry (registre du commerce et des sociétés) of Paris under number 552 120 222, as security agent for the Secured Parties (the “Security Agent”); and |

| (4) | ALLEGO CHARGING LTD, a private company limited by shares, incorporated in England and Wales, having its registered office at Saffery Champness, 71 Queen Victoria Street, London, United Kingdom, EC4V 4BE, registered number 10775810, as service of process agent for the Debtors. |

WHEREAS:

| (A) | Pursuant to a EUR 120,000,000 facility agreement entered into on or around the date of this Agreement between, among others, the Debtors, the Mandated Lead Arrangers and Original Lenders (as defined therein) and the Agent and Security Agent (the “Facilities Agreement”), the Original Lenders agreed to provide a term loan facility to the Borrowers named therein. |

| (B) | it is intended that an intercreditor agreement will be entered into on the date hereof between, among others, the Debtors, the Shareholder (as defined therein), the Original Lenders and Mandated Lead Arrangers (as listed therein), and the Agent and Security Agent (the “Intercreditor Agreement”). |

| (C) | It is intended that the Debtors and the Security Agent enter into the Security Documents (as defined below) on the date of this Agreement. |

| (D) | The Debtors wish to undertake parallel obligations to the Security Agent as set out in this Agreement. |

1

IT IS AGREED as follows:

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | Definitions |

“Debtor” means each Original Debtor and any person which becomes a Party as a Debtor in accordance with the terms of Clause 14.7 (New Debtor) of the Intercreditor Agreement.

“Party” means a party to this Agreement.

“Secured Party” has the meaning given to in the Intercreditor Agreement.

“Security Documents” has the meaning given to it in the Intercreditor Agreement.

“Senior Finance Document” has the meaning given to it in the Intercreditor Agreement.

“Senior Lender” has the meaning given to it in the Intercreditor Agreement.

| 1.2 | Construction |

| (a) | Unless a contrary indication appears, a reference in this Agreement to: |

| (i) | the “Agent”, a “Mandated Lead Arranger”, a “Debtor”, a “Party”, the “Security Agent”, or a “Senior Lender” shall be construed to be a reference to it in its capacity as such and not in any other capacity; |

| (ii) | the “Agent”, a “Mandated Lead Arranger”, a “Debtor”, a “Party”, the “Security Agent”, or a “Senior Lender” or any other person shall be construed so as to include its successors in title, permitted assigns and permitted transferees to, or of, its rights and/or obligations under the Debt Documents and, in the case of the Security Agent, any person for the time being appointed as Security Agent or Security Agents in accordance with the Intercreditor Agreement; |

| (iii) | a “Debt Document” or any other agreement or instrument is (other than a reference to a “Debt Document” or any other agreement or instrument in “original form”) a reference to that Debt Document, or other agreement or instrument, as amended, novated, supplemented, extended, restated (however fundamentally and whether or not more onerously) or replaced and includes any change in the purpose of, any extension of or any increase in any facility under that Debt Document or other agreement or instrument as permitted by the Intercreditor Agreement; |

| (iv) | an “amount” includes an amount of cash and an amount of Non-Cash Consideration; |

| (v) | a “person” includes any individual, firm, company, corporation, government, state or agency of a state or any association, trust, joint venture, consortium, partnership or other entity (whether or not having separate legal personality); and |

| (vi) | a provision of law is a reference to that provision as amended or re-enacted. |

| (b) | Section, Clause and Schedule headings are for ease of reference only. |

| 1.3 | Unless otherwise defined in this Agreement, terms defined in the Intercreditor Agreement and/or in the Facilities Agreement have the same meaning in this Agreement. |

| 2. | DESIGNATION |

In accordance with the Facilities Agreement, each of the Holdco and the Agent designate this Agreement as a Finance Document.

2

| 3. | PARALLEL DEBT (COVENANT TO PAY THE SECURITY AGENT) |

| 3.1 | Each Debtor hereby irrevocably and unconditionally undertakes to pay to the Security Agent amounts equal to any amounts owing from time to time by that Debtor to any Secured Party under any Senior Finance Document as and when those amounts are due. |

| 3.2 | Each Debtor and the Security Agent acknowledge that the obligations of each Debtor under Clause 3.1 above are several and are separate and independent from, and shall not in any way limit or affect, the corresponding obligations of that Debtor to any Secured Party under any Senior Finance Document (its “Corresponding Debt”) nor shall the amounts for which each Debtor is liable under Clause 3.1 above (its “Parallel Debt”) be limited or affected in any way by its Corresponding Debt provided that: |

| (a) | the Parallel Debt of each Debtor shall be decreased to the extent that its Corresponding Debt has been irrevocably paid or (in the case of guarantee obligations) discharged; and |

| (b) | the Corresponding Debt of each Debtor shall be decreased to the extent that its Parallel Debt has been irrevocably paid or (in the case of guarantee obligations) discharged; and |

| (c) | the amount of the Parallel Debt of a Debtor shall at all times be equal to the amount of its Corresponding Debt. |

| 3.3 | For the purpose of this Clause 3, the Security Agent acts in its own name and not as a trustee, and its claims in respect of the Parallel Debt shall not be held on trust. The Security granted under the Security Documents to the Security Agent to secure the Parallel Debt is granted to the Security Agent in its capacity as creditor of the Parallel Debt and shall not be held on trust. |

| 3.4 | All monies received or recovered by the Security Agent pursuant to this Clause 3, and all amounts received or recovered by the Security Agent from or by the enforcement of any Security granted to secure the Parallel Debt, shall be applied in accordance with Clause 11.1 (Order of application) of the Intercreditor Agreement. |

| 3.5 | Without limiting or affecting the Security Agent’s rights against the Debtors (whether under this Clause 3 or under any other provision of the Senior Finance Documents), each Debtor acknowledges that: |

| (a) | nothing in this Clause 3 shall impose any obligation on the Security Agent to advance any sum to any Debtor or otherwise under any Senior Finance Document, except in its capacity as a Senior Lender; and |

| (b) | for the purpose of any vote taken under any Senior Finance Document, the Security Agent shall not be regarded as having any participation or commitment other than those which it has in its capacity as a Senior Lender. |

| 4. | SET-OFF |

All payments to be made by a Debtor under this Agreement shall be calculated and made without (and free and clear of any deduction for) set-off or counterclaim.

3

| 5. | CHANGES TO THE PARTIES |

| 5.1 | Assignments and transfers |

| (a) | Subject to, and in accordance with, the terms of the Senior Finance Documents, the Security Agent may transfer or assign any of its rights and/or obligations under this Agreement to a new Security Agent who will assume the rights and obligations hereunder. Each Debtor irrevocably agrees in advance to cooperate with such transfer or assignment and assumption. |

| (b) | A Debtor may not assign, transfer, novate or dispose of any of, or any interest in, its rights and/or obligations under this Agreement other than in accordance with the Finance Documents. |

| 6. | MISCELLANEOUS |

| 6.1 | Notices |

The provisions of Clause 18 (Notices) of the Intercreditor Agreement shall be incorporated into this Agreement as if set out in full in this Agreement and as if references in those clauses to “this Agreement” are references to this Agreement.

| 6.2 | Third Party Rights |

A person who is not a Party has no right under the Contracts (Rights of Third Parties) Act 1999 to enforce or to enjoy the benefit of any term of this Agreement.

| 6.3 | Counterparts |

This Agreement may be executed in any number of counterparts, and this has the same effect as if the signatures on the counterparts were on a single copy of this Agreement.

| 6.4 | Partial invalidity |

If, at any time, any provision of this Agreement is or becomes illegal, invalid or unenforceable in any respect under any law of any jurisdiction, neither the legality, validity or enforceability of the remaining provisions nor the legality, validity or enforceability of that provision under the law of any other jurisdiction will in any way be affected or impaired.

| 7. | GOVERNING LAW |

This Agreement and any non-contractual obligations arising out of or in connection with it are governed by English law.

| 8. | ENFORCEMENT |

| 8.1 | Jurisdiction |

| (a) | The courts of England have exclusive jurisdiction to settle any dispute arising out of or in connection with this Agreement (including a dispute relating to the existence, validity or termination of this Agreement or any non-contractual obligation arising out of or in connection with this Agreement) (a “Dispute”). |

| (b) | The Parties agree that the courts of England are the most appropriate and convenient courts to settle Disputes and accordingly no Party will argue to the contrary. |

| 8.2 | Service of process |

| (a) | Without prejudice to any other mode of service allowed under any relevant law, each Debtor (unless incorporated in England and Wales): |

4

| (i) | irrevocably appoints Allego Charging Ltd as its agent for service of process in relation to any proceedings before the English courts in connection with this Agreement, and Allego Charging Ltd, by its execution of this Agreement, accepts that appointment; and |

| (ii) | agrees that failure by a process agent to notify the relevant Debtor of the process will not invalidate the proceedings concerned; and |

| (b) | If any person appointed as an agent for service of process is unable for any reason to act as agent for service of process, that Debtor must immediately (and in any event within 7 days of such event taking place) appoint another agent on terms acceptable to the Security Agent. Failing this, the Security Agent may appoint another agent for this purpose. |

This Agreement has been entered into in Amsterdam on the date stated at the beginning of this Agreement and executed as a deed by the Debtors and is intended to be and is delivered by them as a deed on the date specified above.

5

SIGNATURES

| The Debtors |

| ALLEGO B.V. |

| Signed as a deed by Allego B.V., a company incorporated in the Netherlands, by

|

| who, in accordance with the laws of that territory, is acting under the authority of the company |

|

| ALLEGO INNOVATIONS B.V. |

| Signed as a deed by Allego Innovations B.V., a company incorporated in the Netherlands, by

|

| who, in accordance with the laws of that territory, is acting under the authority of the company |

|

| ALLEGO HOLDING B.V. |

| Signed as a deed by Allego Holding B.V., a company incorporated in the Netherlands, by |

being a person

being a person |

| who, in accordance with the laws of that territory, is acting under the authority of the company |

|

| Agent |

| SOCIÉTÉ GÉNÉRALE |

| Signed as a deed by Société Générale, a company incorporated in France, by Olivier SADO, being persons who, in accordance with the laws of that territory, are acting under the authority of the company |

|

|

|

|

|

| Security Agent | ||

| SOCIÉTÉ GÉNÉRALE | ||

| Signed as a deed by Société Générale, a company incorporated in France, by Olivier SADO, being person who, in accordance with the laws of that territory, are acting under the authority of the company | ||

|

||

|

|

||

|

|

||

| Process Agent for the Debtors

Signed as a deed by Allego Charging Ltd acting by

in the presence of |

| |

|

| ||

|

| ||

THIS AGREEMENT is made on 2 October 2019 and made between:

| (1) | Allego GmbH (the “Acceding Debtor”); and |

| (2) | SOCIÉTÉ GÉNÉRALE (the “Security Agent”), for itself and each of the other parties to the parallel debt agreement referred to below. |

This agreement is made on 2 October 2019 by the Acceding Debtor in relation to a parallel debt agreement (the “Parallel Debt Agreement”) dated 27 May 2019 between, amongst others, Allego B.V., Allego Innovations B.V. and Allego Holding B.V. as original debtors, SOCIÉTÉ GÉNÉRALE as security agent and agent.

The Acceding Debtor intends to give a guarantee, indemnity or other assurance against loss in respect of Liabilities under the Finance Documents.

IT IS AGREED as follows:

| 1. | Terms defined in the Parallel Debt Agreement shall, unless otherwise defined in this Agreement, bear the same meaning when used in this Agreement. |

| 2. | The Acceding Debtor confirms that it intends to be party to the Parallel Debt Agreement as a Debtor, undertakes to perform all the obligations expressed to be assumed by a Debtor under the Parallel Debt Agreement and agrees that it shall be bound by all the provisions of the Parallel Debt Agreement as if it had been an original party to the Parallel Debt Agreement. |

| 3. | This Agreement and any non-contractual obligations arising out of or in connection with it are governed by, English law. |

| -1- | 36-40692168 |

THIS AGREEMENT has been signed on behalf of the Security Agent and executed as a deed by the Acceding Debtor and is delivered on the date stated above.

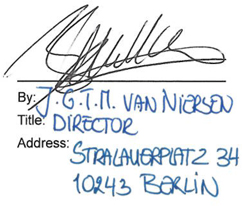

| The Acceding Debtor |

| Allego GmbH |

|

|

|

| By: Title: Address: |

| 36-40692168 | ||||

| Signature pages to Accession Letter Parallel Debt |

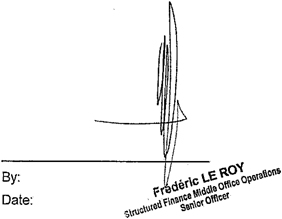

| The Security Agent |

| SOCIÉTÉ GÉNÉRALE |

|

| 36-40692168 | ||||

| Signature pages to Accession Letter Parallel Debt |