Filed by Athena Pubco B.V. CONFIDENTIAL pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Spartan Acquisition Corp. III SEC File No.: 001-40022 O7.21 Date: July, 28 2021 [MATERIALS Enabling FOR DISCUSSION] Electrification CONFIDENTIALFiled by Athena Pubco B.V. CONFIDENTIAL pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Spartan Acquisition Corp. III SEC File No.: 001-40022 O7.21 Date: July, 28 2021 [MATERIALS Enabling FOR DISCUSSION] Electrification CONFIDENTIAL

CONFIDENTIAL Disclaimer This presentation (together with oral statements made in connection herewith, this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to potential financing in connection with a potential business combination between Allego Holding B.V. (“Allego”) and Spartan Acquisition Corp. III (“Spartan”) and related transactions (the “Proposed Business Combination”) and for no other purpose. By accepting this Presentation, you acknowledge and agree that all of the information contained herein or disclosed orally during this Presentation is confidential, that you will not distribute, disclose and use such information for any purpose other than for the purpose of your firm’s participation in the potential financing, that you will not distribute, disclose or use such information in any way detrimental to Allego or Spartan, and that you will return to Allego and Spartan, delete or destroy this Presentation upon request. No representations or warranties, express or implied are given in, or in respect of, this Presentation. You are also being advised that the United States securities laws restrict persons with material non-public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. To the fullest extent permitted by law, in no circumstances will Spartan, Allego or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. In addition, this Presentation does not purport to be all inclusive or to contain all of the information that may be required to make a full analysis of Allego or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of Allego and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Nothing herein should be construed as legal, financial, tax or other advice. You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. The Proposed Business Combination will be submitted to the stockholders of Spartan for their consideration and approval at a special meeting of stockholders. In connection with the Proposed Business Combination, a registration statement on Form F-4 (the “Form F-4”) is expected to be filed by a newly created subsidiary of Allego (“NewCo”) with the SEC, and the prospectus / proxy statement which will form a part thereof will be distributed to holders of Spartan’s common stock, once definitive, in connection with Spartan’s solicitation for proxies for the vote by Spartan’s stockholders in connection with the Proposed Business Combination and other matters as described in the Form F-4. When available, Spartan will mail a definitive proxy statement and other relevant documents to its stockholders as of the record date established for voting on the Proposed Business Combination. Spartan’s stockholders and other interested parties are advised to read, once available, the Form F-4 and any amendments thereto and, once available, the definitive proxy statement and any other documents filed in connection with Spartan’s solicitation of proxies for its special meeting of stockholders to be held to approve the Proposed Business Combination and other matters, as these documents will contain important information about Spartan, Allego, NewCo and the Proposed Business Combination. Stockholders may also obtain a copy of the Form F-4, including the proxy statement/prospectus incorporated therein, once available, as well as other documents filed with the SEC regarding the Proposed Business Combination and other documents filed with the SEC by NewCo and Spartan, without charge, at the SEC ’s website located at www.sec.gov. This Presentation does not constitute a solicitation of any proxy. Spartan, Allego, NewCo and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from Spartan’s stockholders in connection with the Proposed Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Spartan’s stockholders in connection with the Proposed Business Combination will be set forth in the proxy statement/prospectus forming a part of the Form F-4 when it is filed with the SEC. You can find more information about Spartan’s directors and executive officers in Spartan’s final prospectus dated February 8, 2021 and filed with the SEC on February 10, 2021. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus forming a part of the Form F-4 when it becomes available. Stockholders, potential investors and other interested persons should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. When available, these documents can be obtained free of charge from the sources indicated above. NO OFFER OR SOLICITATION This Presentation relates to the potential financing of a portion of the Proposed Business Combination through a private placement of common stock. This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will be offered as a private placement to a limited number of institutional “accredited investors” as defined in Rule 501(a)(1), (2), (3) or (7) under the Act and “Institutional Accounts” as defined in FINRA Rule 4512(c). Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirements of the Securities Act. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time. None of NewCo, Allego or Spartan are making an offer of the Securities in any jurisdiction where the offer is not permitted. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. We have considered whether this Presentation is in scope of the EU Market Abuse Regulation (known as MAR ) and have determined, based on our understanding of U.K. and E.U. MAR and market practice in the United Kingdom and the European Union, that it is not in scope. FORWARD-LOOKING STATEMENTS All statements other than statements of historical facts contained in this Presentation are forward-looking statements. Forward looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,”, “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or other similar expressions (or the negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics, projections of market opportunity and market share, the satisfaction of closing conditions to the potential transaction and the potential financing of the Proposed Business Combination, the level of redemptions by Spartan’s public stockholders and the timing of the completion of the potential transaction, including the anticipated closing date of the Proposed Business Combination and the use of the cash proceeds therefrom. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Allego’s and Spartan’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of Allego and Spartan. These forward-looking statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of the stockholders of Spartan is not obtained; (iii) the ability to maintain the listing of the combined company’s securities on NYSE or another national securities exchange; (iv) the inability to complete the potential financing of the Proposed Business Combination; (v) the risk that the Proposed Business Combination disrupts current plans and operations of Spartan or Allego as a result of the announcement and consummation of the transaction described herein; (vi) the risk that any of the conditions to closing are not satisfied in the anticipated manner or on the anticipated timeline; (vii) the failure to realize the anticipated benefits of the Proposed Business Combination; (viii) risks relating to the uncertainty of the projected financial information with respect to Allego and costs related to the Proposed Business Combination; (ix) risks related to the rollout of Allego’s business strategy and the timing of expected business milestones; (x) the effects of competition on Allego’s future business and the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (xi) risks related to political and macroeconomic uncertainty; (xii) the outcome of any legal proceedings that may be instituted against Spartan, Allego or any of their respective directors or officers, following the announcement of the potential transaction; (xiii) the amount of redemption requests made by Spartan’s public stockholders; (xiv) the ability of Spartan or the combined company to issue equity or equity linked securities or obtain debt financing in connection with the Proposed Business Combination or in the future; (xv) the impact of the global COVID 19 pandemic on any of the foregoing risks; (xvi) those factors discussed in Spartan’s final prospectus dated February 8, 2021 and any Quarterly Report on Form 10-Q or any Annual Report on Form 10-K, in each case, under the heading “Risk Factors,” and other documents of Spartan filed, or to be filed, with the SEC; and (xvii) the classification of its warrants for accounting purposes. If any of these risks materialize or Spartan’s or Allego’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward- looking statements. There may be additional risks that neither Spartan nor Allego presently know or that Spartan and Allego currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Spartan’s and Allego’ s expectations, plans or forecasts of future events and views as of the date of this Presentation. Spartan and Allego anticipate that subsequent events and developments will cause Spartan’s and Allego’s assessments to change. However, while Spartan and Allego may elect to update these forward-looking statements at some point in the future, Spartan and Allego specifically disclaim any obligation to do so, unless required by applicable law. These forward looking statements should not be relied upon as representing Spartan’s and Allego’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. 1

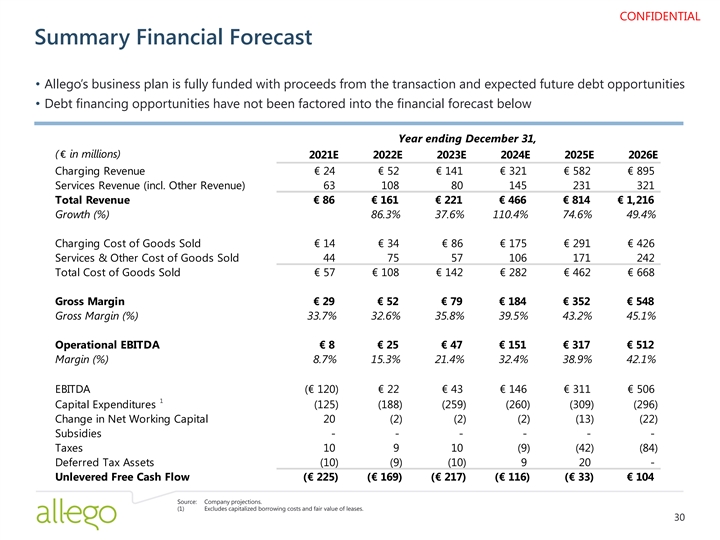

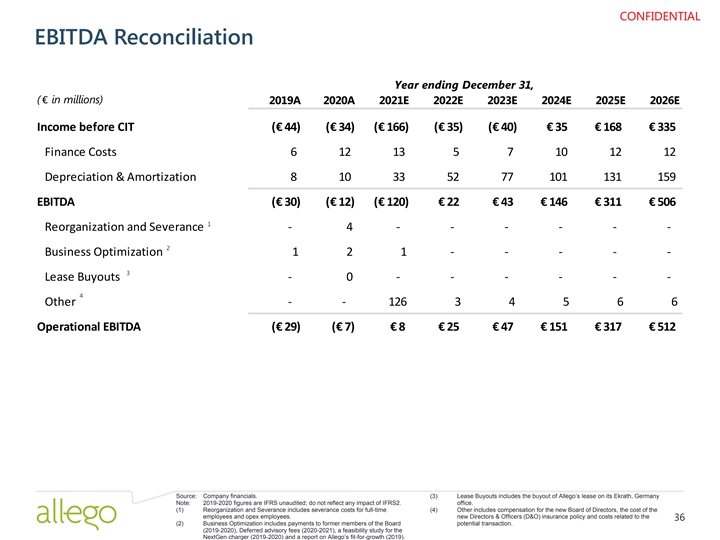

CONFIDENTIAL Disclaimer INDUSTRY AND MARKET DATA Although all information and opinions expressed in this Presentation, including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, Allego and Spartan have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness. Some data is also based on the good faith estimates of Allego and Spartan, which are derived from their respective reviews of internal sources as well as the independent sources described above. This Presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Allego and Spartan. USE OF PROJECTIONS This Presentation contains projected financial information with respect to Allego, including, but not limited to, estimated results for fiscal years 2021 to 2026. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Neither Spartan’s nor Allego’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. FINANCIAL INFORMATION; NON-GAAP FINANCIAL MEASURES; CURRENCY CONVERSION The financial information and data contained in this Presentation, including as of and for fiscal year 2020, is unaudited and does not conform to Regulation S-X promulgated under the Securities Act. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement, prospectus or registration statement to be filed by NewCo or Spartan with the SEC. Some of the financial information and data contained in this Presentation, such as EBITDA, Operational EBITDA and free cash flow, have not been prepared in accordance with Dutch generally accepted accounting principles (“Dutch GAAP”), United States generally accepted accounting principles (“U.S. GAAP” and together with Dutch GAAP, “GAAP”, as the context may require) or the International Financial Reporting Standards (“IFRS”). We define (i) EBITDA as earnings before interest expense, taxes, depreciation and amortization, (ii) Operational EBITDA as EBITDA further adjusted for reorganization costs, certain business optimization costs, lease buyouts, anticipated board compensation costs and director and officer insurance costs and anticipated transaction costs and (iii) free cash flow as net cash flow from operating activities less capital expenditures. Spartan and Allego believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Allego’s financial condition and results of operations. Allego’s management uses these non-GAAP measures for trend analyses, for purposes of determining management incentive compensation and for budgeting and planning purposes. Spartan and Allego believe that the use of these non- GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends and in comparing Allego’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Allego’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results and reconciliations to the most directly comparable GAAP measure are provided in the Appendix to this Presentation. Allego’s financial results are denominated in euros. In order to compare its results with those of comparable businesses, Allego’s financial results or projected results may be denominated in US dollars in the Presentation, representing an exchange rate of 1.18 USD/EUR as of 7/23/2021. CERTAIN MATTERS REGARDING THE ACCOUNTING TREATMENT OF WARRANTS In light of the SEC's Staff Statement on Accounting and Reporting Considerations for Warrants Issued by Special Purpose Acquisition Companies issued on April 12, 2021 (the “Statement”), Spartan is currently re-evaluating the classification of its warrants for accounting purposes. If Spartan concludes that its warrants should be accounted for as a liability (rather than as equity), the fair value of the warrants will need to be determined, Spartan's previously issued financial statements may be subject to revision or restatement, and Spartan may be required to file a Form 8-K under Item 4.02 (Non Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review). Relatedly, Spartan is also assessing the adequacy of its internal controls over financial reporting and disclosure controls and procedures and is considering whether its prior disclosure on the evaluation of such internal controls needs to be revised in amended filings. This assessment may result in the identification of a material weakness in Spartan's internal controls over financial reporting and disclosure controls and procedures. The full impact of the Statement is still being assessed and as such further risks may be identified with respect thereto. TRADEMARKS AND TRADE NAMES Allego and Spartan own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with Allego or Spartan, or an endorsement or sponsorship by or of Allego or Spartan. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Allego or Spartan will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. CERTAIN RISKS RELATED TO ALLEGO All references to the “Company,” “Allego,” “we,” “us,” or “our” in this presentation refer to the business of Allego. The risks presented below are certain of the general risks related to Company’s business, industry and ownership structure and are not exhaustive. The list below is qualified in its entirety by disclosures contained in future filings by the Company, its affiliates or by third parties with the United States Securities and Exchange Commission (“SEC”). These risks speak only as of the date of the Presentation, and we have no obligation to update the disclosures contained herein. The risks highlighted in future filings with the SEC may differ significantly from and will be more extensive than those presented below. Additional risks related to Allego in connection with and following the consummation of the Proposed Business Combination are described above under “Forward Looking Statements.” · Allego is an early stage company with a history of operating losses, and expects to incur significant expenses and continuing losses for the near term and medium term. · Allego has experienced rapid growth and expects to invest substantially in growth for the foreseeable future. If it fails to manage growth effectively, its business, operating results and financial condition could be adversely affected. · Allego’s forecasts and projections are based upon assumptions, analyses and internal estimates developed by Allego’s management. If these assumptions, analyses or estimates prove to be incorrect or inaccurate, Allego’s actual operating results may differ adversely and materially from those forecasted or projected. · Allego’s estimates of market opportunity and forecasts of market growth may prove to be inaccurate. · Allego currently faces competition from a number of companies and expects to face significant competition in the future as the market for EV charging develops. · Allego faces risks related to health pandemics, including the recent COVID-19 pandemic, which could have a material adverse effect on its business and results of operations. · Allego relies on a limited number of suppliers and manufacturers for its hardware equipment and charging stations. A loss of any of these partners could negatively affect its business. · Allego’s business is subject to risks associated with construction, grid connections, permitting, cost overruns and delays, and other contingencies that may arise in the course of completing installations, and such risks may increase in the future as Allego accelerates its development, expands its charging networks and increase its service to third parties. · Allego’s business is subject to risks associated with increased cost of land and competition from third parties that can create cost overruns and delays and can decrease the value of some of Allego’s charging stations. 2CONFIDENTIAL Disclaimer INDUSTRY AND MARKET DATA Although all information and opinions expressed in this Presentation, including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, Allego and Spartan have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness. Some data is also based on the good faith estimates of Allego and Spartan, which are derived from their respective reviews of internal sources as well as the independent sources described above. This Presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Allego and Spartan. USE OF PROJECTIONS This Presentation contains projected financial information with respect to Allego, including, but not limited to, estimated results for fiscal years 2021 to 2026. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Neither Spartan’s nor Allego’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. FINANCIAL INFORMATION; NON-GAAP FINANCIAL MEASURES; CURRENCY CONVERSION The financial information and data contained in this Presentation, including as of and for fiscal year 2020, is unaudited and does not conform to Regulation S-X promulgated under the Securities Act. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement, prospectus or registration statement to be filed by NewCo or Spartan with the SEC. Some of the financial information and data contained in this Presentation, such as EBITDA, Operational EBITDA and free cash flow, have not been prepared in accordance with Dutch generally accepted accounting principles (“Dutch GAAP”), United States generally accepted accounting principles (“U.S. GAAP” and together with Dutch GAAP, “GAAP”, as the context may require) or the International Financial Reporting Standards (“IFRS”). We define (i) EBITDA as earnings before interest expense, taxes, depreciation and amortization, (ii) Operational EBITDA as EBITDA further adjusted for reorganization costs, certain business optimization costs, lease buyouts, anticipated board compensation costs and director and officer insurance costs and anticipated transaction costs and (iii) free cash flow as net cash flow from operating activities less capital expenditures. Spartan and Allego believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Allego’s financial condition and results of operations. Allego’s management uses these non-GAAP measures for trend analyses, for purposes of determining management incentive compensation and for budgeting and planning purposes. Spartan and Allego believe that the use of these non- GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends and in comparing Allego’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Allego’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results and reconciliations to the most directly comparable GAAP measure are provided in the Appendix to this Presentation. Allego’s financial results are denominated in euros. In order to compare its results with those of comparable businesses, Allego’s financial results or projected results may be denominated in US dollars in the Presentation, representing an exchange rate of 1.18 USD/EUR as of 7/23/2021. CERTAIN MATTERS REGARDING THE ACCOUNTING TREATMENT OF WARRANTS In light of the SEC's Staff Statement on Accounting and Reporting Considerations for Warrants Issued by Special Purpose Acquisition Companies issued on April 12, 2021 (the “Statement”), Spartan is currently re-evaluating the classification of its warrants for accounting purposes. If Spartan concludes that its warrants should be accounted for as a liability (rather than as equity), the fair value of the warrants will need to be determined, Spartan's previously issued financial statements may be subject to revision or restatement, and Spartan may be required to file a Form 8-K under Item 4.02 (Non Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review). Relatedly, Spartan is also assessing the adequacy of its internal controls over financial reporting and disclosure controls and procedures and is considering whether its prior disclosure on the evaluation of such internal controls needs to be revised in amended filings. This assessment may result in the identification of a material weakness in Spartan's internal controls over financial reporting and disclosure controls and procedures. The full impact of the Statement is still being assessed and as such further risks may be identified with respect thereto. TRADEMARKS AND TRADE NAMES Allego and Spartan own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with Allego or Spartan, or an endorsement or sponsorship by or of Allego or Spartan. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Allego or Spartan will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. CERTAIN RISKS RELATED TO ALLEGO All references to the “Company,” “Allego,” “we,” “us,” or “our” in this presentation refer to the business of Allego. The risks presented below are certain of the general risks related to Company’s business, industry and ownership structure and are not exhaustive. The list below is qualified in its entirety by disclosures contained in future filings by the Company, its affiliates or by third parties with the United States Securities and Exchange Commission (“SEC”). These risks speak only as of the date of the Presentation, and we have no obligation to update the disclosures contained herein. The risks highlighted in future filings with the SEC may differ significantly from and will be more extensive than those presented below. Additional risks related to Allego in connection with and following the consummation of the Proposed Business Combination are described above under “Forward Looking Statements.” · Allego is an early stage company with a history of operating losses, and expects to incur significant expenses and continuing losses for the near term and medium term. · Allego has experienced rapid growth and expects to invest substantially in growth for the foreseeable future. If it fails to manage growth effectively, its business, operating results and financial condition could be adversely affected. · Allego’s forecasts and projections are based upon assumptions, analyses and internal estimates developed by Allego’s management. If these assumptions, analyses or estimates prove to be incorrect or inaccurate, Allego’s actual operating results may differ adversely and materially from those forecasted or projected. · Allego’s estimates of market opportunity and forecasts of market growth may prove to be inaccurate. · Allego currently faces competition from a number of companies and expects to face significant competition in the future as the market for EV charging develops. · Allego faces risks related to health pandemics, including the recent COVID-19 pandemic, which could have a material adverse effect on its business and results of operations. · Allego relies on a limited number of suppliers and manufacturers for its hardware equipment and charging stations. A loss of any of these partners could negatively affect its business. · Allego’s business is subject to risks associated with construction, grid connections, permitting, cost overruns and delays, and other contingencies that may arise in the course of completing installations, and such risks may increase in the future as Allego accelerates its development, expands its charging networks and increase its service to third parties. · Allego’s business is subject to risks associated with increased cost of land and competition from third parties that can create cost overruns and delays and can decrease the value of some of Allego’s charging stations. 2

CONFIDENTIAL Disclaimer · Allego’s business is subject to risks associated with the price of electricity and the cost of grid connection and capacity which may hamper its profitability and growth. · Allego is dependent on the availability, supply and sufficiency of electricity at its current and future charging sites. Delays and/or other restrictions on the availability of electricity would adversely affect Allego’s business and results of operations. · Allego’s public charging points are often located in areas that must be freely accessible and may be exposed to vandalism or misuse by customers or other individuals, which would increase Allego’s replacement and maintenance costs. · If Allego fails to offer high-quality support to its customers and fails to maintain the availability of its charging points, its business and reputation may suffer. · Allego’s EV driver base and services business will depend upon the effective operation of Allego’s EV Cloud Platform and its applications with mobile service providers, firmware from hardware manufacturers, mobile operating systems, communication networks and standards that Allego does not control. · Allego’s business is dependent upon the hardware of third parties. Issues with the quality or safety of such hardware or any deficiencies with such third parties’ quality and safety controls may affect the profitability and reputation of Allego. Expansion of Allego’s operations may increase such risks. · While Allego to date has not made material acquisitions, should it pursue acquisitions in the future, it would be subject to risks associated with acquisitions. · If Allego is unable to attract and retain key employees and hire qualified management, technical, engineering and sales personnel, its ability to compete and successfully grow its business would be harmed. · Allego is expanding operations in many countries in Europe, which will expose it to additional tax, compliance, market, local rules and other risks. · Members of Allego’s management have limited experience in operating a public company. · Allego may need to raise additional funds or debt and these funds may not be available when needed. · Allego’s future revenue growth will depend in significant part on its ability to increase the number of its charging sites and the sales of services to business to business customers. · Computer malware, viruses, ransomware, hacking, phishing attacks and similar disruptions could result in security and privacy breaches and interruption in service, which could harm Allego’s business. · New technology of alternative fuels may negatively impact the growth of EV market and thus the demand for Allego’s charging stations and services. · The EV charging market is characterized by rapid technological change, which requires Allego to continue develop new innovations of its software platform and to keep up with new hardware technologies. Any delays in such development could adversely affect market adoption of its solutions and Allego’s financial results. · Certain estimates of market opportunity and forecasts of market growth included in this Presentation may prove to be inaccurate. · Allego may need to defend against intellectual property infringement or misappropriation claims, which may be time-consuming and expensive. · Allego’s business may be adversely affected if it is unable to protect its technology and intellectual property from unauthorized use by third parties. · The current lack of international standards may lead to uncertainty, additional competition and further unexpected costs. · Allego’s technology could have undetected defects, errors or bugs in hardware or software which could reduce market adoption, damage its reputation with current or prospective customers, and/or expose it to product liability and other claims that could materially and adversely affect its business. · Interruptions, delays in service or inability to increase capacity, including internationally, at third-party data center facilities could impair the use or functionality of Allego’s operation, harm its business and subject it to liability. · Allego expects to incur research and development costs and devote significant resources to developing new solutions and services, new technologies, which could significantly reduce its profitability and may never result in revenue to Allego. · Allego may inaccurately forecast demand of its sites and may be unable to increase the demand of its public charging points network, which could adversely affect its profitability and growth. · Allego’s business will depend on the utilization of its network by EV drivers and the mobility service providers (“MSPs”) to offer access to our network. If EV drivers do not continue to use our network or MSPs do not continue to offer access to our network, Allego’s business and operating results will be adversely affected. · Failure to effectively expand Allego’s sites could harm its ability to increase revenue. 3CONFIDENTIAL Disclaimer · Allego’s business is subject to risks associated with the price of electricity and the cost of grid connection and capacity which may hamper its profitability and growth. · Allego is dependent on the availability, supply and sufficiency of electricity at its current and future charging sites. Delays and/or other restrictions on the availability of electricity would adversely affect Allego’s business and results of operations. · Allego’s public charging points are often located in areas that must be freely accessible and may be exposed to vandalism or misuse by customers or other individuals, which would increase Allego’s replacement and maintenance costs. · If Allego fails to offer high-quality support to its customers and fails to maintain the availability of its charging points, its business and reputation may suffer. · Allego’s EV driver base and services business will depend upon the effective operation of Allego’s EV Cloud Platform and its applications with mobile service providers, firmware from hardware manufacturers, mobile operating systems, communication networks and standards that Allego does not control. · Allego’s business is dependent upon the hardware of third parties. Issues with the quality or safety of such hardware or any deficiencies with such third parties’ quality and safety controls may affect the profitability and reputation of Allego. Expansion of Allego’s operations may increase such risks. · While Allego to date has not made material acquisitions, should it pursue acquisitions in the future, it would be subject to risks associated with acquisitions. · If Allego is unable to attract and retain key employees and hire qualified management, technical, engineering and sales personnel, its ability to compete and successfully grow its business would be harmed. · Allego is expanding operations in many countries in Europe, which will expose it to additional tax, compliance, market, local rules and other risks. · Members of Allego’s management have limited experience in operating a public company. · Allego may need to raise additional funds or debt and these funds may not be available when needed. · Allego’s future revenue growth will depend in significant part on its ability to increase the number of its charging sites and the sales of services to business to business customers. · Computer malware, viruses, ransomware, hacking, phishing attacks and similar disruptions could result in security and privacy breaches and interruption in service, which could harm Allego’s business. · New technology of alternative fuels may negatively impact the growth of EV market and thus the demand for Allego’s charging stations and services. · The EV charging market is characterized by rapid technological change, which requires Allego to continue develop new innovations of its software platform and to keep up with new hardware technologies. Any delays in such development could adversely affect market adoption of its solutions and Allego’s financial results. · Certain estimates of market opportunity and forecasts of market growth included in this Presentation may prove to be inaccurate. · Allego may need to defend against intellectual property infringement or misappropriation claims, which may be time-consuming and expensive. · Allego’s business may be adversely affected if it is unable to protect its technology and intellectual property from unauthorized use by third parties. · The current lack of international standards may lead to uncertainty, additional competition and further unexpected costs. · Allego’s technology could have undetected defects, errors or bugs in hardware or software which could reduce market adoption, damage its reputation with current or prospective customers, and/or expose it to product liability and other claims that could materially and adversely affect its business. · Interruptions, delays in service or inability to increase capacity, including internationally, at third-party data center facilities could impair the use or functionality of Allego’s operation, harm its business and subject it to liability. · Allego expects to incur research and development costs and devote significant resources to developing new solutions and services, new technologies, which could significantly reduce its profitability and may never result in revenue to Allego. · Allego may inaccurately forecast demand of its sites and may be unable to increase the demand of its public charging points network, which could adversely affect its profitability and growth. · Allego’s business will depend on the utilization of its network by EV drivers and the mobility service providers (“MSPs”) to offer access to our network. If EV drivers do not continue to use our network or MSPs do not continue to offer access to our network, Allego’s business and operating results will be adversely affected. · Failure to effectively expand Allego’s sites could harm its ability to increase revenue. 3

CONFIDENTIAL Today’s Presenters Julien Touati Mathieu Bonnet Allego Board Chairman, Meridiam Partner Chief Executive Officer E 6 Alexis Galley Ton Louwers Chief Technology Officer Chief Operating Officer Geoffrey Strong Olivia Wassenaar Spartan Chairman & CEO, Apollo Senior Partner – Spartan Director, Apollo Senior Partner – Co-Lead Infrastructure and Natural Resources Co-Lead of Natural Resources • 12 years at Apollo • 3 years at Apollo • 15+ years experience in the energy sector • 15+ years experience in the energy and renewable sectors Joseph Romeo Corinne Still Spartan Director, Apollo Principal and Co-Lead of Apollo Principal – Infrastructure Spartan Platform • 5 years at Apollo • 8 years at Apollo • 13+ years experience in the energy and • 11+ years experience in the energy and renewable sectors renewable sectors 4CONFIDENTIAL Today’s Presenters Julien Touati Mathieu Bonnet Allego Board Chairman, Meridiam Partner Chief Executive Officer E 6 Alexis Galley Ton Louwers Chief Technology Officer Chief Operating Officer Geoffrey Strong Olivia Wassenaar Spartan Chairman & CEO, Apollo Senior Partner – Spartan Director, Apollo Senior Partner – Co-Lead Infrastructure and Natural Resources Co-Lead of Natural Resources • 12 years at Apollo • 3 years at Apollo • 15+ years experience in the energy sector • 15+ years experience in the energy and renewable sectors Joseph Romeo Corinne Still Spartan Director, Apollo Principal and Co-Lead of Apollo Principal – Infrastructure Spartan Platform • 5 years at Apollo • 8 years at Apollo • 13+ years experience in the energy and • 11+ years experience in the energy and renewable sectors renewable sectors 4

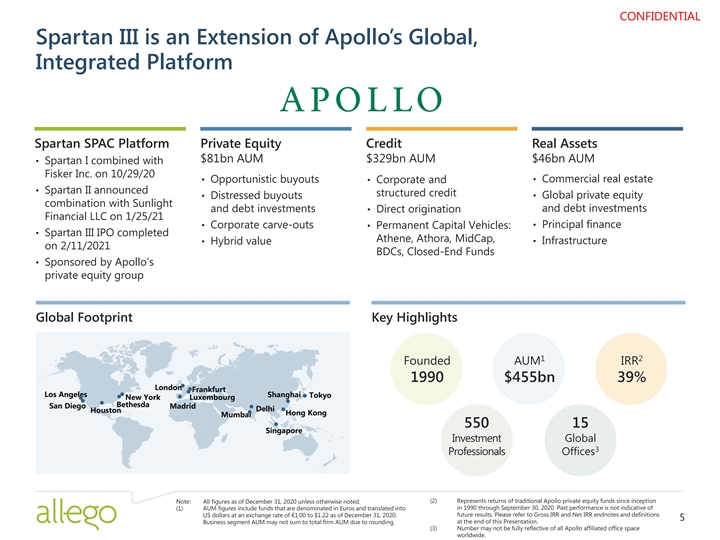

CONFIDENTIAL Spartan III is an Extension of Apollo’s Global, Integrated Platform Spartan SPAC Platform Private Equity Credit Real Assets $81bn AUM $329bn AUM $46bn AUM • Spartan I combined with Fisker Inc. on 10/29/20 • Commercial real estate • Opportunistic buyouts • Corporate and • Spartan II announced structured credit • Distressed buyouts • Global private equity combination with Sunlight and debt investments and debt investments • Direct origination Financial LLC on 1/25/21 • Corporate carve-outs • Principal finance • Permanent Capital Vehicles: • Spartan III IPO completed Athene, Athora, MidCap, • Infrastructure • Hybrid value on 2/11/2021 BDCs, Closed-End Funds • Sponsored by Apollo’s private equity group Global Footprint Key Highlights 1 2 Founded AUM IRR 1990 $455bn 39% London Frankfurt Los Angeles Shanghai Tokyo New York Luxembourg Bethesda San Diego Madrid Delhi Houston Hong Kong Mumbai 550 15 Singapore Investment Global 3 Professionals Offices (2) Represents returns of traditional Apollo private equity funds since inception Note: All figures as of December 31, 2020 unless otherwise noted. in 1990 through September 30, 2020. Past performance is not indicative of (1) AUM figures include funds that are denominated in Euros and translated into US dollars at an exchange rate of €1.00 to $1.22 as of December 31, 2020. future results. Please refer to Gross IRR and Net IRR endnotes and definitions 5 Business segment AUM may not sum to total firm AUM due to rounding. at the end of this Presentation. (3) Number may not be fully reflective of all Apollo affiliated office space worldwide. .CONFIDENTIAL Spartan III is an Extension of Apollo’s Global, Integrated Platform Spartan SPAC Platform Private Equity Credit Real Assets $81bn AUM $329bn AUM $46bn AUM • Spartan I combined with Fisker Inc. on 10/29/20 • Commercial real estate • Opportunistic buyouts • Corporate and • Spartan II announced structured credit • Distressed buyouts • Global private equity combination with Sunlight and debt investments and debt investments • Direct origination Financial LLC on 1/25/21 • Corporate carve-outs • Principal finance • Permanent Capital Vehicles: • Spartan III IPO completed Athene, Athora, MidCap, • Infrastructure • Hybrid value on 2/11/2021 BDCs, Closed-End Funds • Sponsored by Apollo’s private equity group Global Footprint Key Highlights 1 2 Founded AUM IRR 1990 $455bn 39% London Frankfurt Los Angeles Shanghai Tokyo New York Luxembourg Bethesda San Diego Madrid Delhi Houston Hong Kong Mumbai 550 15 Singapore Investment Global 3 Professionals Offices (2) Represents returns of traditional Apollo private equity funds since inception Note: All figures as of December 31, 2020 unless otherwise noted. in 1990 through September 30, 2020. Past performance is not indicative of (1) AUM figures include funds that are denominated in Euros and translated into US dollars at an exchange rate of €1.00 to $1.22 as of December 31, 2020. future results. Please refer to Gross IRR and Net IRR endnotes and definitions 5 Business segment AUM may not sum to total firm AUM due to rounding. at the end of this Presentation. (3) Number may not be fully reflective of all Apollo affiliated office space worldwide. .

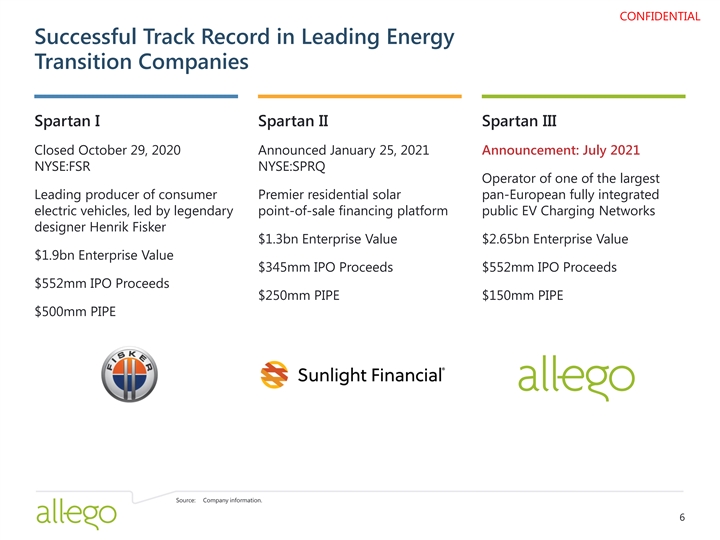

CONFIDENTIAL Successful Track Record in Leading Energy Transition Companies Spartan I Spartan II Spartan III Closed October 29, 2020 Announced January 25, 2021 Announcement: July 2021 NYSE:FSR NYSE:SPRQ Operator of one of the largest Leading producer of consumer Premier residential solar pan-European fully integrated electric vehicles, led by legendary point-of-sale financing platform public EV Charging Networks designer Henrik Fisker $1.3bn Enterprise Value $2.65bn Enterprise Value $1.9bn Enterprise Value $345mm IPO Proceeds $552mm IPO Proceeds $552mm IPO Proceeds $250mm PIPE $150mm PIPE $500mm PIPE Source: Company information. 6

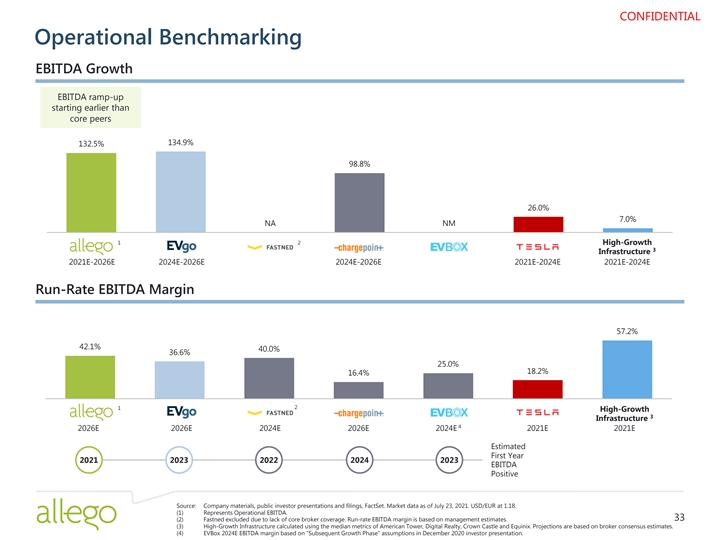

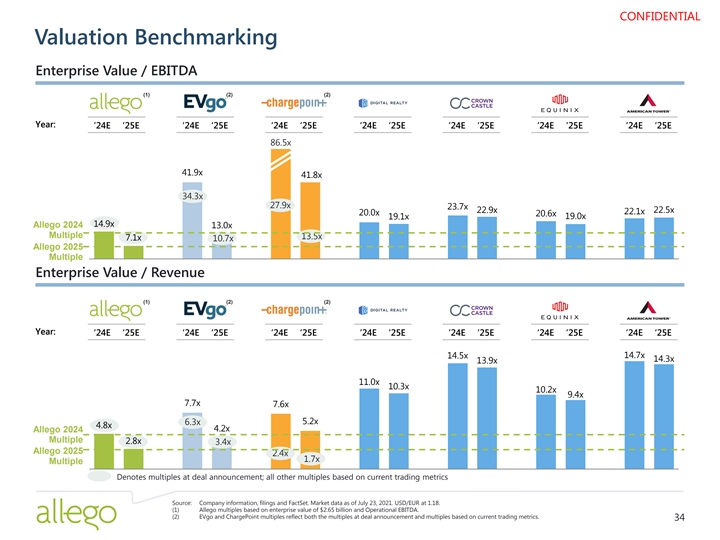

CONFIDENTIAL Investment Highlights Large and Rapidly Growing Total Addressable Market • Growth in electric vehicles unlocks a significant addressable market - particularly for European charging 1 1 • Total TWh demand expected to grow ~8x by 2025 and ~30x by 2030 Leading Pan-European Player with a Clear First Mover Advantage • One of the largest European networks of chargers and a pan-European player 2 • Partnerships with municipalities, 50+ real estate owners and 15+ OEMs • Secured backlog of premium sites provides near-term visibility Market Leading Proprietary Technology Provides a Competitive Advantage • Proprietary 100+ variable analytics and technology platform informs optimal location / network design and performance 3 • Operating software allows compatibility with all vehicle OEMs creating an optimized user experience Strong Unit Economics • Proven ability to generate significant returns from owned sites with expected 30%+ IRR and ~4-year payback at the site level 4 • Allego can operate independently and produce high margins from owned sites without reliance on government incentives Attractive Valuation • Attractive entry valuation at a discount to both current trading level of comparable companies and 5 precedent deSPAC transactions • Allego is expected to achieve positive Operational EBITDA in 2021 and has established scale vs. competitors Source: Company information. (1) Management estimates. 7CONFIDENTIAL Investment Highlights Large and Rapidly Growing Total Addressable Market • Growth in electric vehicles unlocks a significant addressable market - particularly for European charging 1 1 • Total TWh demand expected to grow ~8x by 2025 and ~30x by 2030 Leading Pan-European Player with a Clear First Mover Advantage • One of the largest European networks of chargers and a pan-European player 2 • Partnerships with municipalities, 50+ real estate owners and 15+ OEMs • Secured backlog of premium sites provides near-term visibility Market Leading Proprietary Technology Provides a Competitive Advantage • Proprietary 100+ variable analytics and technology platform informs optimal location / network design and performance 3 • Operating software allows compatibility with all vehicle OEMs creating an optimized user experience Strong Unit Economics • Proven ability to generate significant returns from owned sites with expected 30%+ IRR and ~4-year payback at the site level 4 • Allego can operate independently and produce high margins from owned sites without reliance on government incentives Attractive Valuation • Attractive entry valuation at a discount to both current trading level of comparable companies and 5 precedent deSPAC transactions • Allego is expected to achieve positive Operational EBITDA in 2021 and has established scale vs. competitors Source: Company information. (1) Management estimates. 7

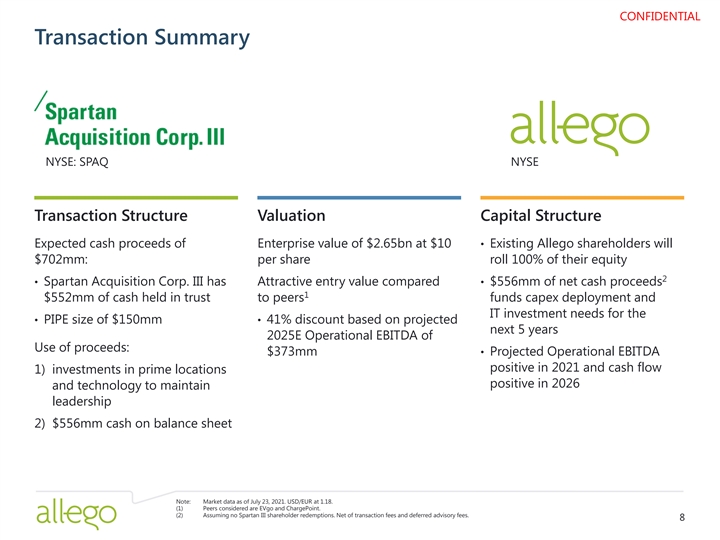

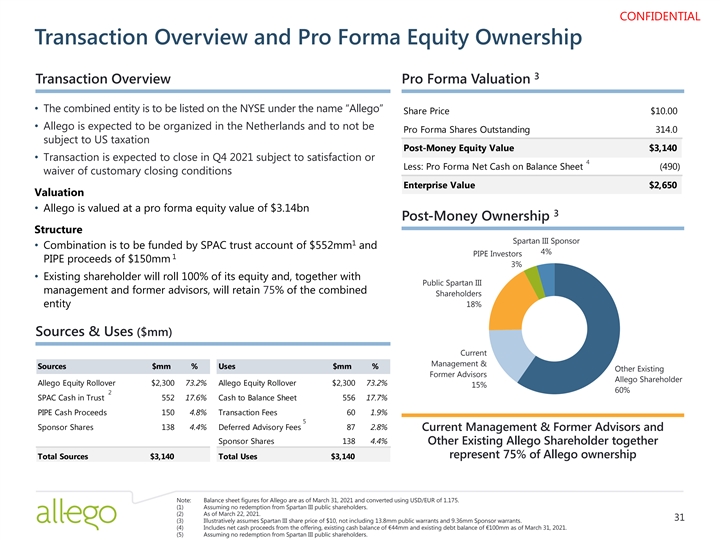

CONFIDENTIAL Transaction Summary NYSE: SPAQ NYSE Transaction Structure Valuation Capital Structure Expected cash proceeds of Enterprise value of $2.65bn at $10 • Existing Allego shareholders will $702mm: per share roll 100% of their equity 2 • Spartan Acquisition Corp. III has Attractive entry value compared • $556mm of net cash proceeds 1 $552mm of cash held in trust to peers funds capex deployment and IT investment needs for the • PIPE size of $150mm • 41% discount based on projected next 5 years 2025E Operational EBITDA of Use of proceeds: $373mm • Projected Operational EBITDA positive in 2021 and cash flow 1) investments in prime locations positive in 2026 and technology to maintain leadership 2) $556mm cash on balance sheet Note: Market data as of July 23, 2021. USD/EUR at 1.18. (1) Peers considered are EVgo and ChargePoint. (2) Assuming no Spartan III shareholder redemptions. Net of transaction fees and deferred advisory fees. 8CONFIDENTIAL Transaction Summary NYSE: SPAQ NYSE Transaction Structure Valuation Capital Structure Expected cash proceeds of Enterprise value of $2.65bn at $10 • Existing Allego shareholders will $702mm: per share roll 100% of their equity 2 • Spartan Acquisition Corp. III has Attractive entry value compared • $556mm of net cash proceeds 1 $552mm of cash held in trust to peers funds capex deployment and IT investment needs for the • PIPE size of $150mm • 41% discount based on projected next 5 years 2025E Operational EBITDA of Use of proceeds: $373mm • Projected Operational EBITDA positive in 2021 and cash flow 1) investments in prime locations positive in 2026 and technology to maintain leadership 2) $556mm cash on balance sheet Note: Market data as of July 23, 2021. USD/EUR at 1.18. (1) Peers considered are EVgo and ChargePoint. (2) Assuming no Spartan III shareholder redemptions. Net of transaction fees and deferred advisory fees. 8

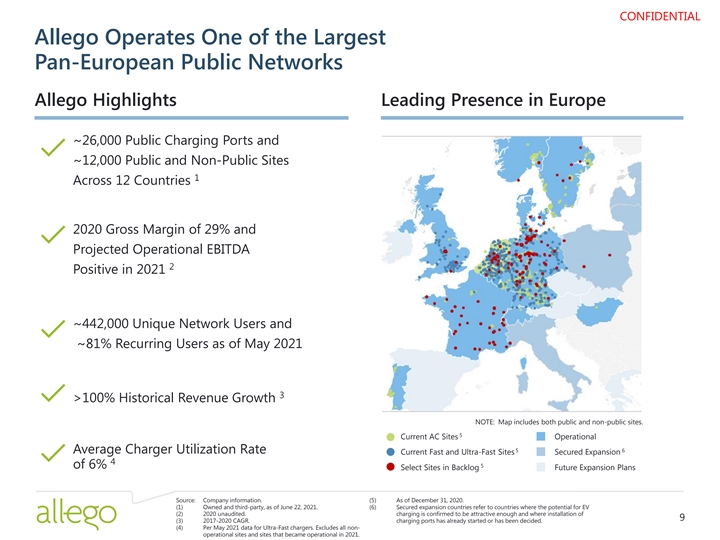

CONFIDENTIAL Allego Operates One of the Largest Pan-European Public Networks Allego Highlights Leading Presence in Europe ~26,000 Public Charging Ports and ~12,000 Public and Non-Public Sites 1 Across 12 Countries 2020 Gross Margin of 29% and Projected Operational EBITDA 2 Positive in 2021 ~442,000 Unique Network Users and ~81% Recurring Users as of May 2021 3 >100% Historical Revenue Growth NOTE: Map includes both public and non-public sites. 5 Current AC Sites Operational 5 6 Average Charger Utilization Rate Current Fast and Ultra-Fast Sites Secured Expansion 4 5 of 6% Select Sites in Backlog Future Expansion Plans Source: Company information. (5) As of December 31, 2020. (1) Owned and third-party, as of June 22, 2021. (6) Secured expansion countries refer to countries where the potential for EV (2) 2020 unaudited. charging is confirmed to be attractive enough and where installation of 9 (3) 2017-2020 CAGR. charging ports has already started or has been decided. (4) Per May 2021 data for Ultra-Fast chargers. Excludes all non- operational sites and sites that became operational in 2021.CONFIDENTIAL Allego Operates One of the Largest Pan-European Public Networks Allego Highlights Leading Presence in Europe ~26,000 Public Charging Ports and ~12,000 Public and Non-Public Sites 1 Across 12 Countries 2020 Gross Margin of 29% and Projected Operational EBITDA 2 Positive in 2021 ~442,000 Unique Network Users and ~81% Recurring Users as of May 2021 3 >100% Historical Revenue Growth NOTE: Map includes both public and non-public sites. 5 Current AC Sites Operational 5 6 Average Charger Utilization Rate Current Fast and Ultra-Fast Sites Secured Expansion 4 5 of 6% Select Sites in Backlog Future Expansion Plans Source: Company information. (5) As of December 31, 2020. (1) Owned and third-party, as of June 22, 2021. (6) Secured expansion countries refer to countries where the potential for EV (2) 2020 unaudited. charging is confirmed to be attractive enough and where installation of 9 (3) 2017-2020 CAGR. charging ports has already started or has been decided. (4) Per May 2021 data for Ultra-Fast chargers. Excludes all non- operational sites and sites that became operational in 2021.

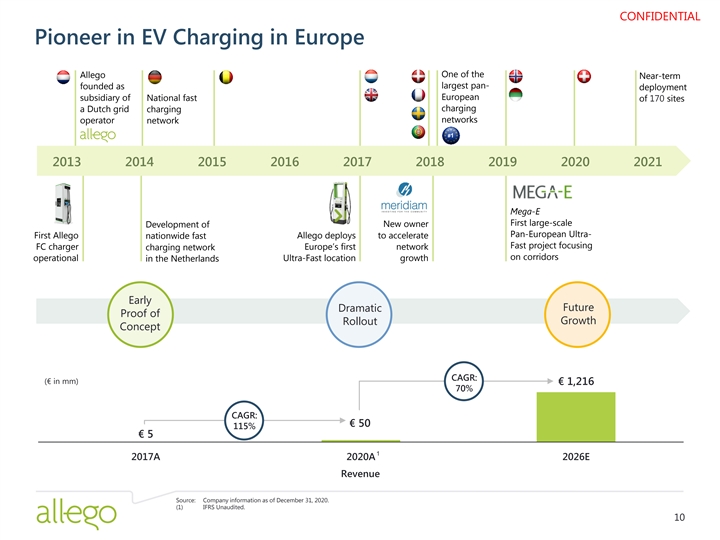

CONFIDENTIAL Pioneer in EV Charging in Europe One of the Allego Near-term founded as largest pan- deployment European subsidiary of National fast of 170 sites charging a Dutch grid charging operator networks network #1 2013 2014 2015 2016 2017 2018 2019 2020 2021 Mega-E First large-scale New owner Development of Pan-European Ultra- First Allego Allego deploys to accelerate nationwide fast Fast project focusing FC charger charging network Europe’s first network on corridors operational Ultra-Fast location growth in the Netherlands Early Future Dramatic Proof of Growth Rollout Concept CAGR: (€ in mm) € 1,216 70% CAGR: € 50 115% € 5 1 2017A 2020A 2026E Revenue Source: Company information as of December 31, 2020. (1) IFRS Unaudited. 10CONFIDENTIAL Pioneer in EV Charging in Europe One of the Allego Near-term founded as largest pan- deployment European subsidiary of National fast of 170 sites charging a Dutch grid charging operator networks network #1 2013 2014 2015 2016 2017 2018 2019 2020 2021 Mega-E First large-scale New owner Development of Pan-European Ultra- First Allego Allego deploys to accelerate nationwide fast Fast project focusing FC charger charging network Europe’s first network on corridors operational Ultra-Fast location growth in the Netherlands Early Future Dramatic Proof of Growth Rollout Concept CAGR: (€ in mm) € 1,216 70% CAGR: € 50 115% € 5 1 2017A 2020A 2026E Revenue Source: Company information as of December 31, 2020. (1) IFRS Unaudited. 10

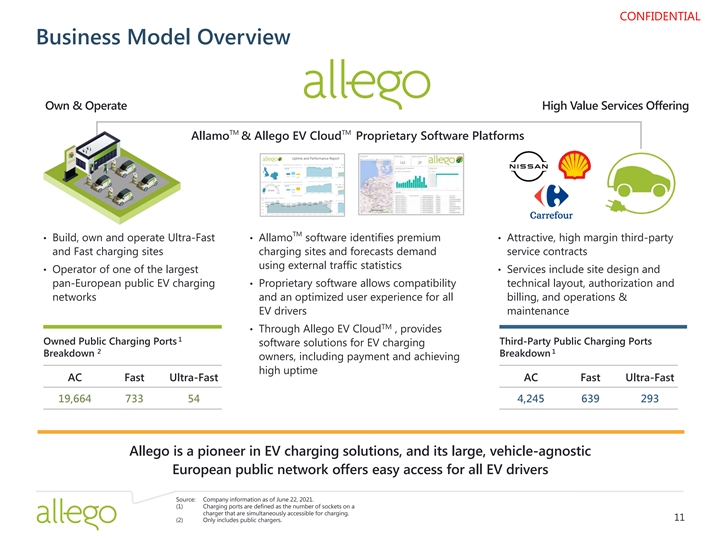

CONFIDENTIAL Business Model Overview Own & Operate High Value Services Offering TM TM Allamo & Allego EV Cloud Proprietary Software Platforms TM • Build, own and operate Ultra-Fast • Allamo software identifies premium • Attractive, high margin third-party and Fast charging sites charging sites and forecasts demand service contracts using external traffic statistics • Operator of one of the largest • Services include site design and pan-European public EV charging • Proprietary software allows compatibility technical layout, authorization and networks and an optimized user experience for all billing, and operations & EV drivers maintenance TM • Through Allego EV Cloud , provides 1 Owned Public Charging Ports Third-Party Public Charging Ports software solutions for EV charging 2 1 Breakdown Breakdown owners, including payment and achieving high uptime AC Fast Ultra-Fast AC Fast Ultra-Fast 19,664 733 54 4,245 639 293 Allego is a pioneer in EV charging solutions, and its large, vehicle-agnostic European public network offers easy access for all EV drivers Source: Company information as of June 22, 2021. (1) Charging ports are defined as the number of sockets on a charger that are simultaneously accessible for charging. 11 (2) Only includes public chargers.CONFIDENTIAL Business Model Overview Own & Operate High Value Services Offering TM TM Allamo & Allego EV Cloud Proprietary Software Platforms TM • Build, own and operate Ultra-Fast • Allamo software identifies premium • Attractive, high margin third-party and Fast charging sites charging sites and forecasts demand service contracts using external traffic statistics • Operator of one of the largest • Services include site design and pan-European public EV charging • Proprietary software allows compatibility technical layout, authorization and networks and an optimized user experience for all billing, and operations & EV drivers maintenance TM • Through Allego EV Cloud , provides 1 Owned Public Charging Ports Third-Party Public Charging Ports software solutions for EV charging 2 1 Breakdown Breakdown owners, including payment and achieving high uptime AC Fast Ultra-Fast AC Fast Ultra-Fast 19,664 733 54 4,245 639 293 Allego is a pioneer in EV charging solutions, and its large, vehicle-agnostic European public network offers easy access for all EV drivers Source: Company information as of June 22, 2021. (1) Charging ports are defined as the number of sockets on a charger that are simultaneously accessible for charging. 11 (2) Only includes public chargers.

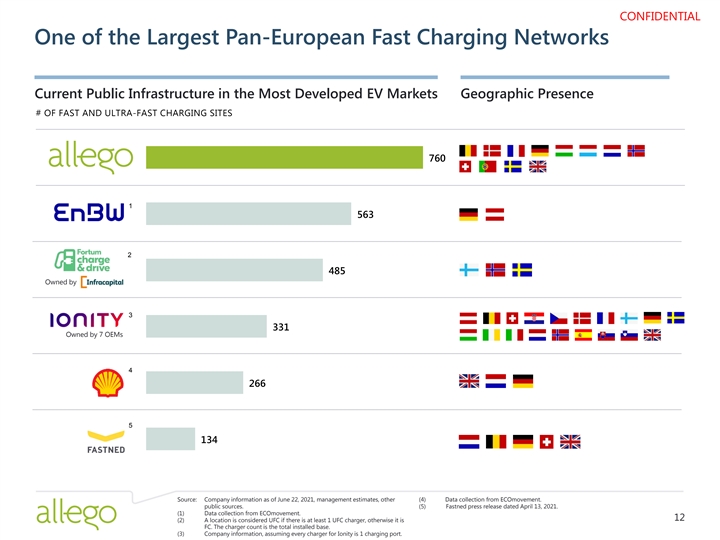

CONFIDENTIAL One of the Largest Pan-European Fast Charging Networks Current Public Infrastructure in the Most Developed EV Markets Geographic Presence # OF FAST AND ULTRA-FAST CHARGING SITES 760 1 563 2 485 Owned by 3 331 Owned by 7 OEMs 4 266 5 134 Source: Company information as of June 22, 2021, management estimates, other (4) Data collection from ECOmovement. public sources. (5) Fastned press release dated April 13, 2021. (1) Data collection from ECOmovement. 12 (2) A location is considered UFC if there is at least 1 UFC charger, otherwise it is FC. The charger count is the total installed base. (3) Company information, assuming every charger for Ionity is 1 charging port.CONFIDENTIAL One of the Largest Pan-European Fast Charging Networks Current Public Infrastructure in the Most Developed EV Markets Geographic Presence # OF FAST AND ULTRA-FAST CHARGING SITES 760 1 563 2 485 Owned by 3 331 Owned by 7 OEMs 4 266 5 134 Source: Company information as of June 22, 2021, management estimates, other (4) Data collection from ECOmovement. public sources. (5) Fastned press release dated April 13, 2021. (1) Data collection from ECOmovement. 12 (2) A location is considered UFC if there is at least 1 UFC charger, otherwise it is FC. The charger count is the total installed base. (3) Company information, assuming every charger for Ionity is 1 charging port.

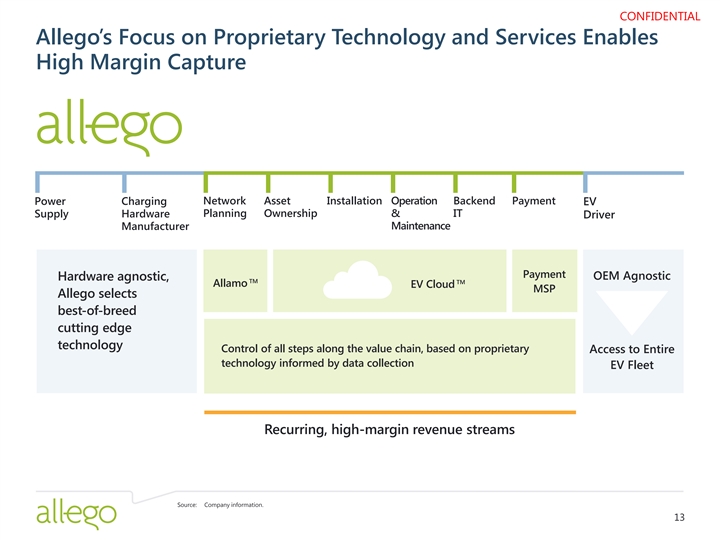

CONFIDENTIAL Allego’s Focus on Proprietary Technology and Services Enables High Margin Capture Network Asset Installation Operation Backend Payment Power Charging EV Planning Ownership & IT Supply Hardware Driver Manufacturer Maintenance Payment OEM Agnostic Hardware agnostic, TM TM Allamo EV Cloud MSP Allego selects best-of-breed cutting edge technology Control of all steps along the value chain, based on proprietary Access to Entire technology informed by data collection EV Fleet Recurring, high-margin revenue streams Source: Company information. 13

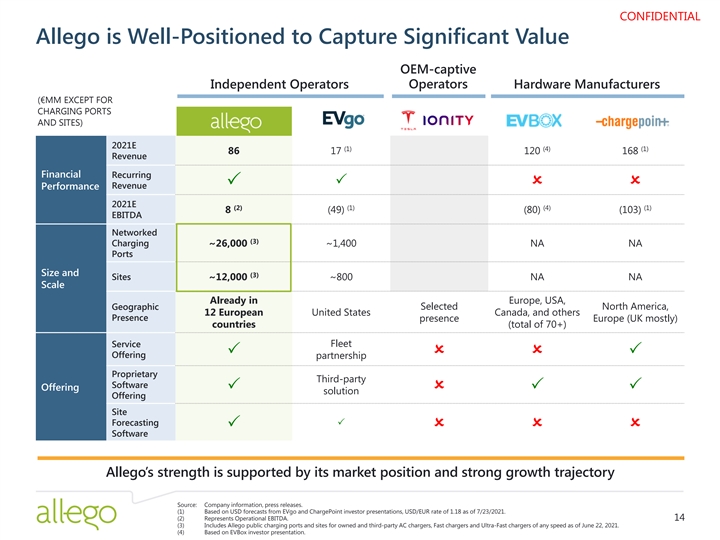

CONFIDENTIAL Allego is Well-Positioned to Capture Significant Value OEM-captive Operators Independent Operators Hardware Manufacturers (€MM EXCEPT FOR CHARGING PORTS AND SITES) 2021E (1) (4) (1) 86 17 120 168 Revenue Financial Recurring POO P Revenue Performance 2021E (2) (1) (4) (1) 8 (49) (80) (103) EBITDA Networked (3) Charging ~26,000 ~1,400 NA NA Ports Size and (3) Sites ~12,000 ~800 NA NA Scale Already in Europe, USA, Geographic Selected North America, 12 European United States Canada, and others Presence presence Europe (UK mostly) countries (total of 70+) Service Fleet POOP Offering partnership Proprietary Third-party Software OfferingPOPP solution Offering Site ForecastingP POOO Software Allego’s strength is supported by its market position and strong growth trajectory Source: Company information, press releases. (1) Based on USD forecasts from EVgo and ChargePoint investor presentations, USD/EUR rate of 1.18 as of 7/23/2021. (2) Represents Operational EBITDA. 14 (3) Includes Allego public charging ports and sites for owned and third-party AC chargers, Fast chargers and Ultra-Fast chargers of any speed as of June 22, 2021. (4) Based on EVBox investor presentation.CONFIDENTIAL Allego is Well-Positioned to Capture Significant Value OEM-captive Operators Independent Operators Hardware Manufacturers (€MM EXCEPT FOR CHARGING PORTS AND SITES) 2021E (1) (4) (1) 86 17 120 168 Revenue Financial Recurring POO P Revenue Performance 2021E (2) (1) (4) (1) 8 (49) (80) (103) EBITDA Networked (3) Charging ~26,000 ~1,400 NA NA Ports Size and (3) Sites ~12,000 ~800 NA NA Scale Already in Europe, USA, Geographic Selected North America, 12 European United States Canada, and others Presence presence Europe (UK mostly) countries (total of 70+) Service Fleet POOP Offering partnership Proprietary Third-party Software OfferingPOPP solution Offering Site ForecastingP POOO Software Allego’s strength is supported by its market position and strong growth trajectory Source: Company information, press releases. (1) Based on USD forecasts from EVgo and ChargePoint investor presentations, USD/EUR rate of 1.18 as of 7/23/2021. (2) Represents Operational EBITDA. 14 (3) Includes Allego public charging ports and sites for owned and third-party AC chargers, Fast chargers and Ultra-Fast chargers of any speed as of June 22, 2021. (4) Based on EVBox investor presentation.

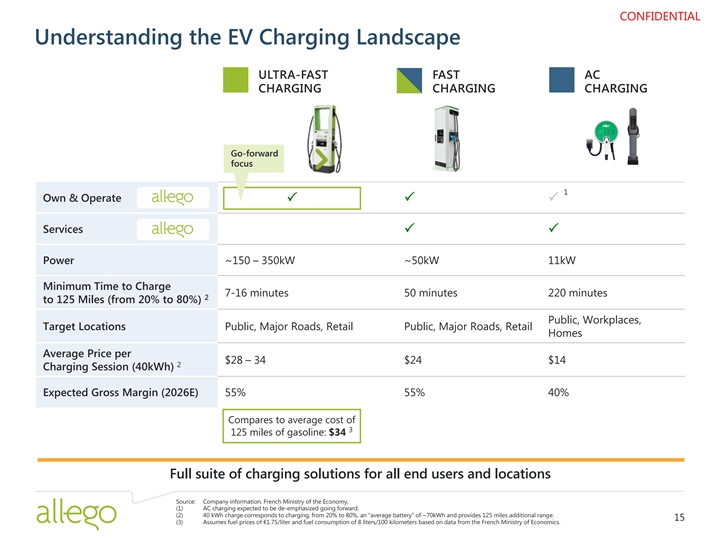

CONFIDENTIAL Understanding the EV Charging Landscape ULTRA-FAST FAST AC CHARGING CHARGING CHARGING Go-forward focus 1 Own & Operate PPP Services PP Power ~150 – 350kW ~50kW 11kW Minimum Time to Charge 7-16 minutes 50 minutes 220 minutes 2 to 125 Miles (from 20% to 80%) Public, Workplaces, Target Locations Public, Major Roads, Retail Public, Major Roads, Retail Homes Average Price per $28 – 34 $24 $14 2 Charging Session (40kWh) Expected Gross Margin (2026E) 55% 55% 40% Compares to average cost of 3 125 miles of gasoline: $34 Full suite of charging solutions for all end users and locations Source: Company information, French Ministry of the Economy, (1) AC charging expected to be de-emphasized going forward. (2) 40 kWh charge corresponds to charging, from 20% to 80%, an average battery of ~70kWh and provides 125 miles additional range. 15 (3) Assumes fuel prices of €1.75/liter and fuel consumption of 8 liters/100 kilometers based on data from the French Ministry of Economics.CONFIDENTIAL Understanding the EV Charging Landscape ULTRA-FAST FAST AC CHARGING CHARGING CHARGING Go-forward focus 1 Own & Operate PPP Services PP Power ~150 – 350kW ~50kW 11kW Minimum Time to Charge 7-16 minutes 50 minutes 220 minutes 2 to 125 Miles (from 20% to 80%) Public, Workplaces, Target Locations Public, Major Roads, Retail Public, Major Roads, Retail Homes Average Price per $28 – 34 $24 $14 2 Charging Session (40kWh) Expected Gross Margin (2026E) 55% 55% 40% Compares to average cost of 3 125 miles of gasoline: $34 Full suite of charging solutions for all end users and locations Source: Company information, French Ministry of the Economy, (1) AC charging expected to be de-emphasized going forward. (2) 40 kWh charge corresponds to charging, from 20% to 80%, an average battery of ~70kWh and provides 125 miles additional range. 15 (3) Assumes fuel prices of €1.75/liter and fuel consumption of 8 liters/100 kilometers based on data from the French Ministry of Economics.

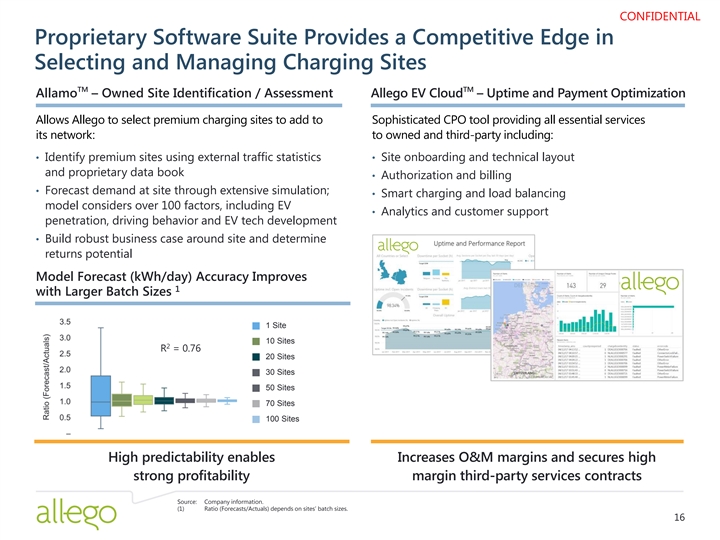

CONFIDENTIAL Proprietary Software Suite Provides a Competitive Edge in Selecting and Managing Charging Sites TM TM Allamo – Owned Site Identification / Assessment Allego EV Cloud – Uptime and Payment Optimization Allows Allego to select premium charging sites to add to Sophisticated CPO tool providing all essential services its network: to owned and third-party including: • Identify premium sites using external traffic statistics • Site onboarding and technical layout and proprietary data book • Authorization and billing • Forecast demand at site through extensive simulation; • Smart charging and load balancing model considers over 100 factors, including EV • Analytics and customer support penetration, driving behavior and EV tech development • Build robust business case around site and determine returns potential Model Forecast (kWh/day) Accuracy Improves 1 with Larger Batch Sizes 1 Site 10 Sites 2 R = 0.76 20 Sites 30 Sites 50 Sites 70 Sites 100 Sites High predictability enables Increases O&M margins and secures high strong profitability margin third-party services contracts Source: Company information. (1) Ratio (Forecasts/Actuals) depends on sites’ batch sizes. 16CONFIDENTIAL Proprietary Software Suite Provides a Competitive Edge in Selecting and Managing Charging Sites TM TM Allamo – Owned Site Identification / Assessment Allego EV Cloud – Uptime and Payment Optimization Allows Allego to select premium charging sites to add to Sophisticated CPO tool providing all essential services its network: to owned and third-party including: • Identify premium sites using external traffic statistics • Site onboarding and technical layout and proprietary data book • Authorization and billing • Forecast demand at site through extensive simulation; • Smart charging and load balancing model considers over 100 factors, including EV • Analytics and customer support penetration, driving behavior and EV tech development • Build robust business case around site and determine returns potential Model Forecast (kWh/day) Accuracy Improves 1 with Larger Batch Sizes 1 Site 10 Sites 2 R = 0.76 20 Sites 30 Sites 50 Sites 70 Sites 100 Sites High predictability enables Increases O&M margins and secures high strong profitability margin third-party services contracts Source: Company information. (1) Ratio (Forecasts/Actuals) depends on sites’ batch sizes. 16

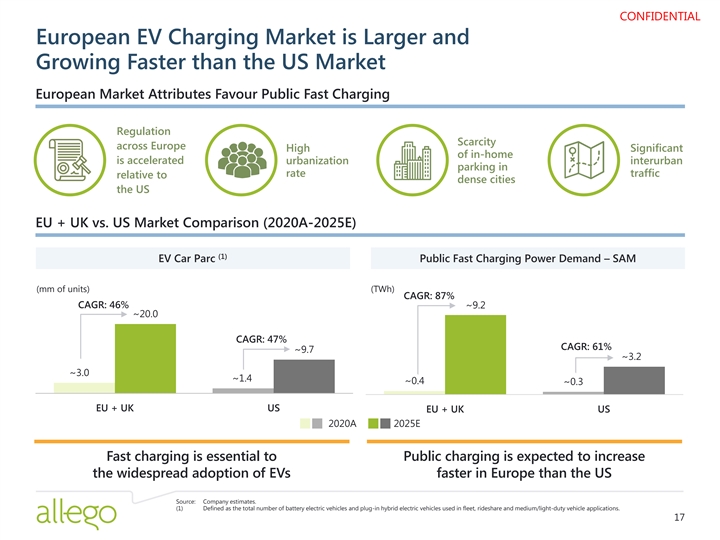

CONFIDENTIAL European EV Charging Market is Larger and Growing Faster than the US Market European Market Attributes Favour Public Fast Charging Regulation Scarcity across Europe High Significant of in-home is accelerated urbanization interurban parking in rate traffic relative to dense cities the US EU + UK vs. US Market Comparison (2020A-2025E) (1) EV Car Parc Public Fast Charging Power Demand – SAM (mm of units) (TWh) CAGR: 87% CAGR: 46% ~9.2 ~20.0 CAGR: 47% CAGR: 61% ~9.7 ~3.2 ~3.0 ~1.4 ~0.4 ~0.3 EU + UK US EU + UK US 2020A 2025E Fast charging is essential to Public charging is expected to increase the widespread adoption of EVs faster in Europe than the US Source: Company estimates. (1) Defined as the total number of battery electric vehicles and plug-in hybrid electric vehicles used in fleet, rideshare and medium/light-duty vehicle applications. 17CONFIDENTIAL European EV Charging Market is Larger and Growing Faster than the US Market European Market Attributes Favour Public Fast Charging Regulation Scarcity across Europe High Significant of in-home is accelerated urbanization interurban parking in rate traffic relative to dense cities the US EU + UK vs. US Market Comparison (2020A-2025E) (1) EV Car Parc Public Fast Charging Power Demand – SAM (mm of units) (TWh) CAGR: 87% CAGR: 46% ~9.2 ~20.0 CAGR: 47% CAGR: 61% ~9.7 ~3.2 ~3.0 ~1.4 ~0.4 ~0.3 EU + UK US EU + UK US 2020A 2025E Fast charging is essential to Public charging is expected to increase the widespread adoption of EVs faster in Europe than the US Source: Company estimates. (1) Defined as the total number of battery electric vehicles and plug-in hybrid electric vehicles used in fleet, rideshare and medium/light-duty vehicle applications. 17

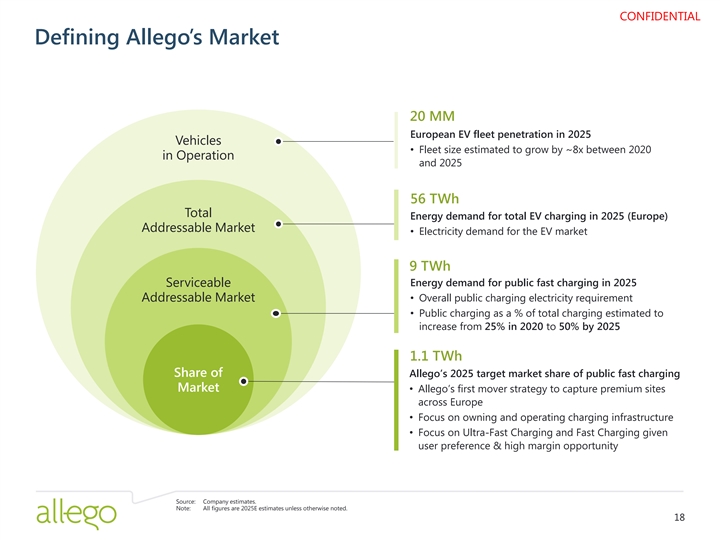

CONFIDENTIAL Defining Allego’s Market 20 MM European EV fleet penetration in 2025 Vehicles • Fleet size estimated to grow by ~8x between 2020 in Operation and 2025 56 TWh Total Energy demand for total EV charging in 2025 (Europe) Addressable Market • Electricity demand for the EV market 9 TWh Energy demand for public fast charging in 2025 Serviceable Addressable Market • Overall public charging electricity requirement • Public charging as a % of total charging estimated to increase from 25% in 2020 to 50% by 2025 1.1 TWh Share of Allego’s 2025 target market share of public fast charging Market • Allego’s first mover strategy to capture premium sites across Europe • Focus on owning and operating charging infrastructure • Focus on Ultra-Fast Charging and Fast Charging given user preference & high margin opportunity Source: Company estimates. Note: All figures are 2025E estimates unless otherwise noted. 18CONFIDENTIAL Defining Allego’s Market 20 MM European EV fleet penetration in 2025 Vehicles • Fleet size estimated to grow by ~8x between 2020 in Operation and 2025 56 TWh Total Energy demand for total EV charging in 2025 (Europe) Addressable Market • Electricity demand for the EV market 9 TWh Energy demand for public fast charging in 2025 Serviceable Addressable Market • Overall public charging electricity requirement • Public charging as a % of total charging estimated to increase from 25% in 2020 to 50% by 2025 1.1 TWh Share of Allego’s 2025 target market share of public fast charging Market • Allego’s first mover strategy to capture premium sites across Europe • Focus on owning and operating charging infrastructure • Focus on Ultra-Fast Charging and Fast Charging given user preference & high margin opportunity Source: Company estimates. Note: All figures are 2025E estimates unless otherwise noted. 18

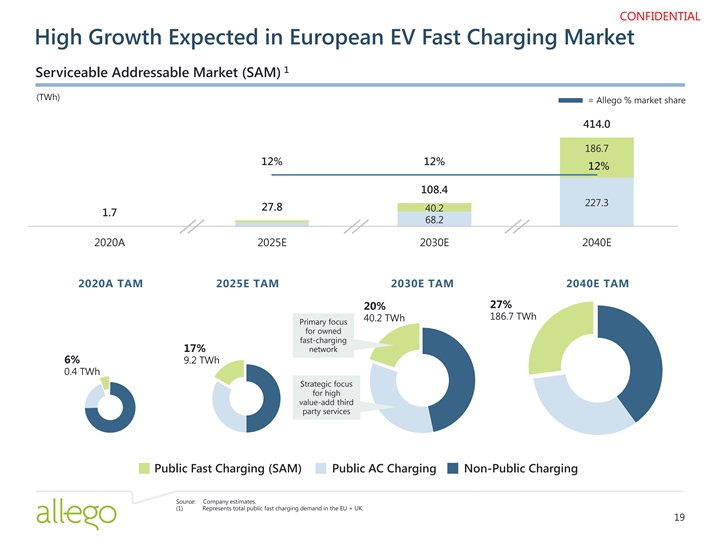

CONFIDENTIAL High Growth Expected in European EV Fast Charging Market 1 Serviceable Addressable Market (SAM) (TWh) = Allego % market share 414.0 186.7 12% 12% 12% 108.4 227.3 27.8 40.2 1.7 68.2 2020A 2025E 2030E 2040E 2020A TAM 2025E TAM 2030E TAM 2040E TAM 27% 20% 186.7 TWh 40.2 TWh Primary focus for owned fast-charging 17% network 6% 9.2 TWh 0.4 TWh Strategic focus for high value-add third party services Public Fast Charging (SAM) Public AC Charging Non-Public Charging Source: Company estimates. (1) Represents total public fast charging demand in the EU + UK. 19CONFIDENTIAL High Growth Expected in European EV Fast Charging Market 1 Serviceable Addressable Market (SAM) (TWh) = Allego % market share 414.0 186.7 12% 12% 12% 108.4 227.3 27.8 40.2 1.7 68.2 2020A 2025E 2030E 2040E 2020A TAM 2025E TAM 2030E TAM 2040E TAM 27% 20% 186.7 TWh 40.2 TWh Primary focus for owned fast-charging 17% network 6% 9.2 TWh 0.4 TWh Strategic focus for high value-add third party services Public Fast Charging (SAM) Public AC Charging Non-Public Charging Source: Company estimates. (1) Represents total public fast charging demand in the EU + UK. 19

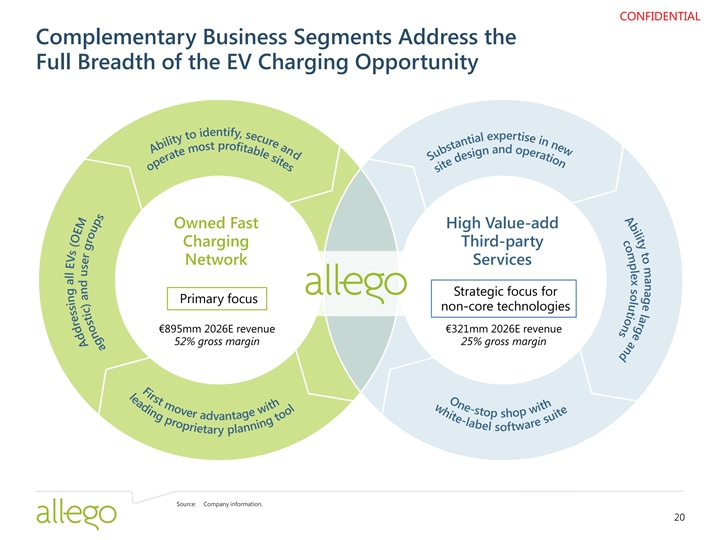

CONFIDENTIAL Complementary Business Segments Address the Full Breadth of the EV Charging Opportunity Owned Fast High Value-add Charging Third-party Network Services Strategic focus for Primary focus non-core technologies €895mm 2026E revenue €321mm 2026E revenue 52% gross margin 25% gross margin Source: Company information. 20

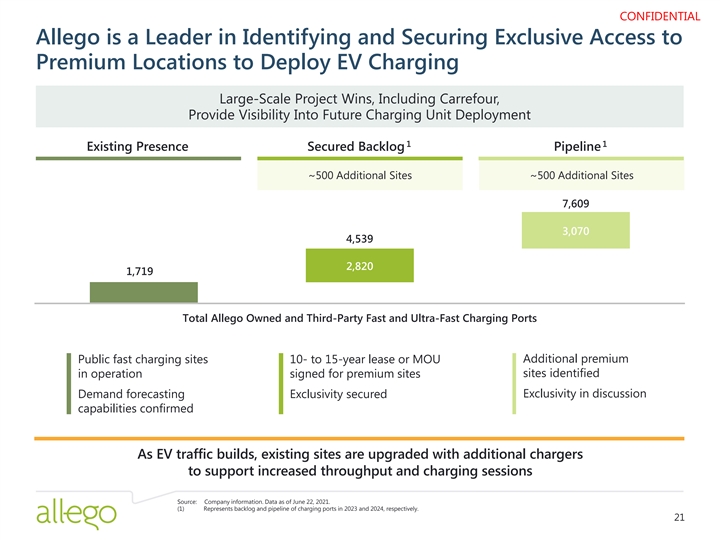

CONFIDENTIAL Allego is a Leader in Identifying and Securing Exclusive Access to Premium Locations to Deploy EV Charging Large-Scale Project Wins, Including Carrefour, Provide Visibility Into Future Charging Unit Deployment 1 1 Existing Presence Secured Backlog Pipeline ~500 Additional Sites ~500 Additional Sites 7,609 3,070 4,539 2,820 1,719 Total Allego Owned and Third-Party Fast and Ultra-Fast Charging Ports Public fast charging sites 10- to 15-year lease or MOU Additional premium sites identified in operation signed for premium sites Demand forecasting Exclusivity secured Exclusivity in discussion capabilities confirmed As EV traffic builds, existing sites are upgraded with additional chargers to support increased throughput and charging sessions Source: Company information. Data as of June 22, 2021. (1) Represents backlog and pipeline of charging ports in 2023 and 2024, respectively. 21CONFIDENTIAL Allego is a Leader in Identifying and Securing Exclusive Access to Premium Locations to Deploy EV Charging Large-Scale Project Wins, Including Carrefour, Provide Visibility Into Future Charging Unit Deployment 1 1 Existing Presence Secured Backlog Pipeline ~500 Additional Sites ~500 Additional Sites 7,609 3,070 4,539 2,820 1,719 Total Allego Owned and Third-Party Fast and Ultra-Fast Charging Ports Public fast charging sites 10- to 15-year lease or MOU Additional premium sites identified in operation signed for premium sites Demand forecasting Exclusivity secured Exclusivity in discussion capabilities confirmed As EV traffic builds, existing sites are upgraded with additional chargers to support increased throughput and charging sessions Source: Company information. Data as of June 22, 2021. (1) Represents backlog and pipeline of charging ports in 2023 and 2024, respectively. 21

CONFIDENTIAL Allego Offers High Value Services for Third Parties that Generate Traffic on Allego’s Network Installation Consulting and Services Operations & Maintenance Software Suite • Design, supervise the • Operate sites on behalf • Provide full EV TM building of and calibrate of third parties Cloud operational sites for third parties support to customers • Perform preventive and • Offering includes network corrective maintenance • Provide access to planning and hardware direct end-user • 24/7 support selection billing Manage site installation for customers Run and service charging sites Provide essential data analytics Overview of Key Service Contracts • All-in service to dealers • Experience with Fast and Ultra-Fast charging Addressable Need • Deploy 723 Fast chargers at dealerships across • Deploy 14 Fast chargers and 47 Ultra-Fast chargers Project 14 countries in the Netherlands; deploy 68 Fast chargers and 25 Ultra-Fast chargers in the UK • 5-year O&M contract • 2-year O&M contract • Pan-European installation services and • One of the few EV charging networks with experience Strategic Fit maintenance capabilities in Fast and Ultra-Fast charging • Interoperability • Installation consulting and services necessary to equip TM fueling stations with EV chargers • EV Cloud services TM • EV Cloud services • Flexibility to onboard new suppliers • Hardware independent • Access to Allego proprietary network Source: Company information. 22